This page was generated automatically. To access the article in its initial context, you can visit the link below:

https://www.businessinsider.com/former-investment-bank-md-achieving-fire-not-worth-it-2025-1

and should you wish to have this article removed from our website, please get in touch with us

- Eric Sim concluded his 20-year career in finance in 2017 after attaining financial independence.

- However, the ex-managing director at an investment bank claims he’s not supportive of the FIRE lifestyle.

- Sim transitioned into being a professional speaker and executive coach following his departure from banking in 2017.

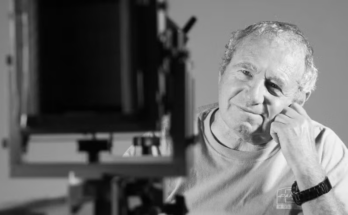

This narrative is based on a discussion with Eric Sim, 54, a prior banker who became a published author, professional speaker, and career coach. The following has undergone edits for brevity and clarity. Business Insider has previously released an essay regarding Sim’s banking profession.

At the start of my banking career, early retirement was not something I pondered much.

I assumed I would retire at 65, participating in standard retirement pastimes like taking cruises and socializing with longtime friends.

However, my perspective shifted when I became a managing director at UBS. After a few years there, earning several annual bonuses, it dawned on me that I was genuinely financially free.

This led to reflections: If I no longer needed to work for anyone, what would I pursue?

I understood that I couldn’t simply resign without a strategy. I required a significant project to which I could direct my efforts.

After considerable contemplation, I opted to exit banking to establish my own training institute aimed at young professionals. In 2015, I launched the Institute of Life with the goal of assisting young people in achieving success in their careers and personal lives.

FIRE may not be as advantageous as you perceive

Eric Sim

Despite having obtained financial independence, I do not advocate for the Financial Independence Retire Early, or FIRE, movement.

To reach FIRE, one needs to set aside a significant portion of their earnings during their employment years. However, the reality is that individuals often lack a clear vision of what retirement will entail for them or whether they will even find it pleasurable — particularly when they are immersed in the process.

Initially, upon retirement, there are endless possibilities. You could travel abroad, indulge at a spa, or hit the golf course.

After spending a decade or two in the workforce, the initial three months of liberation from the daily grind is enjoyable. Yet, the excitement wears off swiftly.

While employed, there’s no need to strategize how to fill your time; your job provides plentiful tasks to fill your day.

On the other hand, if you are financially secure, without a routine to follow, it’s essential to find endeavors that fill your time. Failing to do this will leave you with wasted days.

A fulfilling retirement isn’t solely about accumulating wealth

For a fulfilling retirement, three forms of capital are necessary. Beyond financial capital, both human and social capital are vital for maximizing your time.

Human capital embodies the knowledge you hold. This can be developed through your career choices or pursuits in side projects and hobbies. By enhancing your interests and expertise, you’ll discover what pursuits you wish to engage in once you step into retirement.

Social capital represents the goodwill you’ve built with others. The small acts of assistance you offer may yield significant returns later on in retirement.

Ultimately, it’s critical to determine what you envision doing after exiting your job. If there’s a passion you’ve longed to pursue that holds significance, I would encourage you to chase it.

However, if you lack goals to anticipate and haven’t identified a purpose yet, it’s wise to remain in your current role. You can continue to follow your interests on the side without needing to resign.

This page was generated automatically. To access the article in its initial context, you can visit the link below:

https://www.businessinsider.com/former-investment-bank-md-achieving-fire-not-worth-it-2025-1

and should you wish to have this article removed from our website, please get in touch with us