This page has been generated automatically. To view the article in its initial setting, you may visit the link below:

https://www.gamedeveloper.com/business/five-takeaways-for-game-developers-from-matthew-ball-s-state-of-gaming-data

And should you wish to have this article removed from our website, please reach out to us

Can any single individual articulate the complete condition of the video game industry? Entrepreneur, writer, and Epyllion CEO Matthew Ball is certainly attempting to do so. The individual who authored “The Metaverse” has released a presentation slide deck this week, filled with insights and data outlining the economic challenges currently confronting the sector.

Ball’s presentation addresses a rather stark reality: analysts indicate that spending on video games not only failed to rise post-COVID-19 pandemic but actually decreased by 3.5 percent in 2022, only recovering by a few percentage points by the conclusion of 2024. Other indicators, such as a reduction in gameplay durations, are also sufficient to incite anxiety among game developers (and myself!).

Ball attributes the stagnation in growth to a loss of momentum in significant interwoven growth factors prevalent from 2011 to 2021 (when consoles and mobile devices saw remarkable advances in capabilities and new social platforms emerged). While the picture is not encouraging, the industry revolves around addressing significant challenges by confronting them directly.

His comprehensive analysis of the intricate market dynamics may dissuade investors and corporate leaders from pouring additional funds into the gaming sector—but that opens a door for astute developers and executives to step in and discover opportunities where others have retreated.

I am confident that this slide deck is currently circulating among various studios and passing across the desks of numerous C-suite executives. To effectively utilize Ball’s data, you must contemplate its relevance to your everyday operations. Here are several insights that might resonate with everyday developers.

Video game budgets must decrease

This may be painfully clear to many of our readers, yet Ball’s findings underscore a crucial point: video game budgets are excessively inflated. The financial commitment to individual games is increasingly challenging to recoup as a smaller fraction of players are purchasing new titles each year. “Excluding annual releases yet including sequels, only 6.5 percent of gametime in 2023 was allocated to new games,” Ball states. “Persistently available games-as-a-service released prior to 2019 generated the majority of ‘gametime’ that year. ‘Tens of billions in development and marketing expenditures, along with thousands of games, competed for that 6.5 percent of total player hours (and four titles captured half of it).”

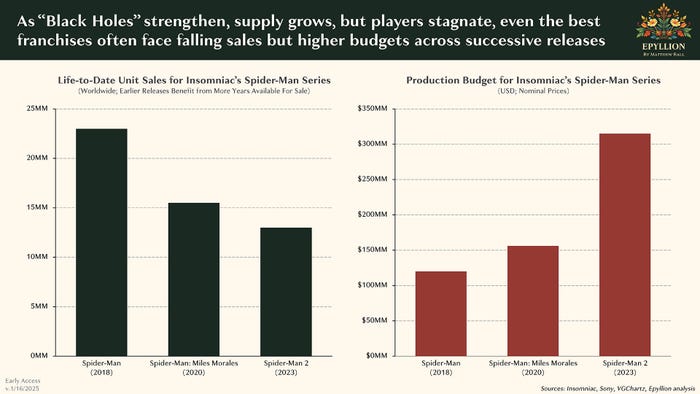

Marvel’s Spider-Man 2 serves as an unfortunate illustration of Ball’s analysis, as his comparison of sales against the budget of the widely acclaimed sequel in relation to its predecessors highlights the core of the issue. The series’ production budget soared from just over $100 million to more than $300 million across three installments (Miles Morales was over $150 million), yet lifetime sales for the series have not exhibited exponential growth.

Image credit: Matthew Ball.

Considering the limited market share this series is vying for, the economic situation becomes challenging. While I am uncertain about the budgets for future Marvel’s Spider-Man titles, I am aware that Insomniac recognizes that players do not necessarily perceive the benefits of the heightened expenditures, a reality revealed in the frustrating release of leaked documents accessed by hackers targeting the studio.

Now, this is where the challenge arises: how can you diminish budgets? There are three primary methods: reducing salaries, shortening development periods, or decreasing headcounts. Each approach carries its own set of frustrating trade-offs that often penalize workers while rewarding executives who inflated the budgets in the first instance.

“`html

Devs need to jazz with authorities

Ball’s data suggests two clear avenues where government regulators could sway the gaming sector—one overt, the other covert.

The covert assertion isn’t explicitly articulated, and I contemplate whether Ball would challenge my interpretation. However, reading between the lines, an understated issue of larger budgets is this: game creation is severely impacted by living expenses and inflation. As we explored last year, the equivalent number of developers assigned to a game incurs vastly different expenses based on the country in which you are operating. Developers in high-cost-of-living areas are being undermined by their counterparts in lower-cost-of-living regions, and developers in those latter areas risk being taken advantage of due to their diminished power to negotiate better salaries.

Image via Matthew Ball.

Ball’s explicit argument focuses on the alleged monopoly that Google and Apple hold over their mobile platforms. He asserts that if the iOS and Android app platforms require “opening up.” New stores could, among other advantages, foster competition that reduces the 30 percent “platform fee” imposed by Google and Apple, promote new discoverability methods that connect players to a more extensive array of games, and ignite innovation for new game genres.

Both issues may compel industry leaders to bear down and advocate for local and national governments to support regulatory measures. To date, industry lobbying organizations have predominantly concentrated on tax incentives and legislation regarding the import costs of components and access to internet bandwidth. This is a significant effort directed toward legislation that primarily benefits the world’s largest publishers and studios.

Just like Mr. Smith, it’s time for video games to head to Washington (or London, Ottawa, etc.).

Players react to thrilling “new genres”—but where do new genres emerge from?

In terms of new game genres, Ball’s examination concludes that the emergence of fresh game genres could invigorate the video game marketplace. He cites the period of the battle royale genre as an event that could propel new growth. The industry, he claims, is in need of a wave of innovation.

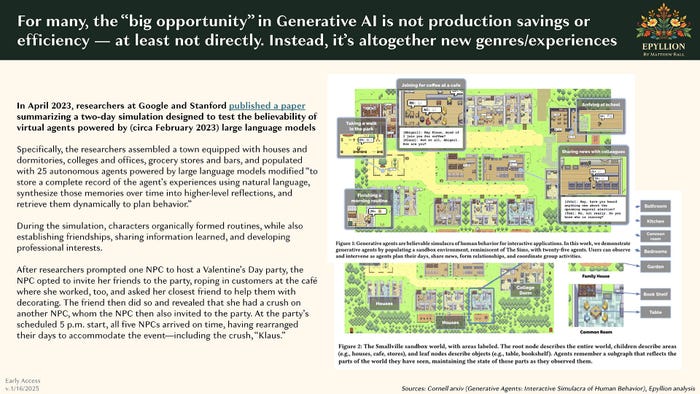

His recommendations for potential origins of new genres focus on possible technological advancements in “mass concurrency,” “high-bandwidth data streaming,” “higher-persistence game worlds,” and “cloud-native games.” His analysis of generative AI also emphasizes the technology’s potential to give rise to new genres, as certain developers like those at Hidden Door are experimenting with.

Image via Matthew Ball.

Ball’s technology-centered perspective is not unwarranted, as many previous advancements in the industry stemmed from graphical and rendering breakthroughs. However, there might be an overlooked factor here: unpaid modding.

Numerous groundbreaking new genres of the 2010s began as mods (stemming from unpaid efforts) for entirely different games. This includes MOBAs, battle royale titles, and tactical shooters like Counter-Strike, among others.

This trend complicates the landscape of where developers can uncover genuine innovation that resonates with players—and who stands to gain from it. Valve and Blizzard took swift action to capitalize on genres based on mods of their games. Meanwhile, Brendan Greene was fortunate to find a business partner who could transform his ARMA 3 mod into a complete game, but Epic Games quickly followed with

“`Fortnite so fiercely that it established the standard version of the category in the United States.

A prominent illustration of this trend presently could be Grand Theft Auto Online‘s roleplaying servers. Their widespread appeal signifies Ball’s assertion that the forthcoming generation of gamers values social engagement over rivalry, and at this moment, Rockstar Games reaps the rewards of unpaid efforts from users creating their own mini improvisational theaters. Will Rockstar capitalize on this fanbase after the launch of Grand Theft Auto VI? Will other creators rush in to try and take away their market share?

Internationalism is influencing the marketplace (and enhancing PC market share)

Video game experts from the early 2000s have quite a bit of egg on their faces, as one of the rare bright spots for the conventional gaming market is continual expansion in the realm of PC games. Declining sales around 2010 led some to speculate that consoles and mobile would inevitably overshadow PC games, which were (and at times still are) tricky and cumbersome to operate.

“Two decades ago, the percentage of non-mobile console expenditure attributed to PCs was 29 percent. It is now 53 percent,” writes Ball. “And while console [spending] has plateaued since 2021, PC has expanded by 20 percent.”

Before you leap from your seat and approve another generation of flight simulators, you should investigate why PC spending is on the rise. “The largest segment of Steam users now have Chinese as their default client language (which likely underrepresents China’s overall share of Steam users),” states Ball.

Additional statistics he presents indicate that users with Chinese as their client language represent one of the fastest-growing categories on Steam from December 2021 to September 2024. This segment embodies what many publishers aspire to reach—an “untapped audience” with distinct preferences and interests compared to the more entrenched existing market.

However, while spending by Chinese players on video games has surged by $39 billion since 2011, only 20 percent of their domestic spending is directed towards imported titles. Expenditure on imported titles dipped by five percent from 2023 through 2024. Ball likens this trend to a parallel occurring in the film sector: locally-produced entertainment is outpacing foreign entertainment globally in China, Nigeria, and India.

Image via Matthew Ball.

Blockbuster films like Wandering Earth, A Tribe Called Judah, and RRR are cinematic relatives of Black Myth: Wukong—content created by local talents that achieve enormous popularity in their countries of origin and also find audiences internationally.

“As foreign markets expand, their domestic production capabilities increase as well, leading to a shift in national preferences favoring local products,” notes Ball.

The gaming industry has a chance to capitalize on this moment. We’ve observed activity from South Korea regarding growing interest in triple-A titles alongside the country’s longstanding enthusiasm for free-to-play multiplayer games, and regions such as Brazil and Eastern Europe are displaying similar patterns.

If you’re outside those areas, you might question how your segment of the gaming industry can take advantage. For the time being, the best I can suggest is that if international audiences spend more time on consoles and PCs than mobile devices, developers have an opportunity to seizesome of that enthusiasm by investing in localization.

Recognizing player socialization should be essential

Interwoven throughout Ball’s examination is another enduring trend: the manner in which players socialize and why is evolving through gaming.

The Roblox trend, for example, isn’t solely about younger gamers attracted to simplistic graphics and user-generated elements; it’s that the platform’s adaptable tools have become a sanctuary for self-expression and communal interaction. We can again reference the surge of Grand Theft Auto Online roleplaying servers as another indicator of this trend and, beyond gaming, the notable rise of the chat service Discord.

“One in five Discord users (or 40 million overall) utilize the app to broadcast gameplay to their friends every month—and just under one in three view it monthly,” Ball states. It acts as a social connector that fuels interest in games like Palworld, Smite 2, Phasmophobia, and Lethal Company.

Discord’s compilation of users engaging with Steam Early Access titles as a percentage of total observed players is predominantly populated with cooperative multiplayer games, but it also includes single-player games like Fields of Mistria, Hades II, and Manor Lords. Ball characterizes this as “disproportionate” game discovery behavior.

Image via Matthew Ball.

The creators behind these titles likely didn’t perform any peculiar research into the habits of Discord users (unless they did, in which case, please reach out to me; I’m curious about your findings), but a sufficient number of them have thrived on the platform in ways that indicate that examining how players interact with and utilize Discord might be a means for developers to expand, investigate new genres, and flourish in 2025 and beyond.

(And Discord may not be solely responsible for this—social applications worldwide likely encourage analogous behaviors in various regions).

How do developers manage an unpredictable future?

I’ll be candid here. Upon my initial reading of Ball’s report, I was left with a degree of apprehension. The human mind finds it challenging to grasp figures like these, and it’s easy to descend into an unproductive cycle of if->then conjectures that render a decline in billions of dollars in expenditure feel apocalyptic. The challenges and solutions are so vast and abstract that if you aren’t a major decision-maker—just a modest programmer, artist, designer, or a writer like myself—you may feel as though you possess no influence in an industry you passionately cherish. And even if you hold the authority to approve a game, what if the titles Ball suggests aren’t the ones you wish to create or are even capable of developing?

The key, I believe, is to interpret Ball’s data and assessment as a navigational guide. Maps serve multiple purposes—they outline the landscape as accurately as possible for another explorer to maneuver through it. Many will interpret Ball’s map and perceive “X marks the spot,” where others might notice “here there be dragons.”

You don’t need to transform or rectify the gaming industry. However, to create the game you aspire to, having a guide available may help you avoid drifting into perilous waters.

This page was generated programmatically; to view the article in its original form, you can visit the link below:

https://www.gamedeveloper.com/business/five-takeaways-for-game-developers-from-matthew-ball-s-state-of-gaming-data

and if you wish to remove this article from our site, please contact us