This web page was created programmatically, to learn the article in its authentic location you possibly can go to the hyperlink bellow:

https://www.ontario.ca/page/2025-26-first-quarter-finances

and if you wish to take away this text from our web site please contact us

Highlights

- Ontario’s actual gross home product (GDP) elevated by 0.6 per cent within the first calendar quarter of 2025, matching development within the earlier quarter. Real GDP development within the first quarter was supported by larger exports and family spending.

- Private-sector expectations for actual GDP development are unchanged for 2025 for the reason that 2025 Budget. Uncertainty associated to U.S. commerce coverage continues to impression the worldwide financial outlook and presents draw back danger to the Ontario economic system.

- As of the 2025–26 First Quarter Finances, the province’s 2025–26 deficit is projected to be $14.6 billion, in line with the outlook revealed within the 2025 Budget.

- Total revenues and bills within the 2025–26 First Quarter Finances are projected to be $219.9 billion and $232.5 billion, respectively, unchanged from the outlook within the 2025 Budget.

Introduction

Ontario’s economic system proved to be resilient in 2024 and continued to develop in early 2025. However, there are important draw back dangers to the financial outlook. Uncertainty associated to U.S. commerce coverage continues to impression the worldwide economic system. Ontario’s important buying and selling relationship with the United States presents elevated dangers and uncertainty, which is predicted to weigh on shopper spending and enterprise funding choices over the close to time period.

The 2025 Budget outlined a plan to guard Ontario’s employees, companies and communities from U.S. tariffs and the financial uncertainty, whereas sustaining a prudent and accountable strategy to public funds. The authorities’s plan will proceed to guard Ontario by fostering essentially the most aggressive economic system within the G7, and selling funding, job creation and enterprise development, whereas retaining a path to funds stability by 2027–28.

Ontario’s funds are within the strongest place they’ve been in over a decade, with all 4 main credit standing companies—Moody’s, Fitch, Morningstar DBRS and S&P Global—affirming Ontario’s credit standing, and the outlook is secure. This displays Ontario’s dedication to sustaining its targets for debt sustainability measures, regardless of the financial and geopolitical uncertainties the province is at present dealing with.

The authorities will present its subsequent financial and monetary replace as a part of the 2025 Ontario Economic Outlook and Fiscal Review, to be launched by November 15, 2025.

Section A: Ontario’s 2025–26 Fiscal Outlook

The province’s 2025–26 deficit is projected to be unchanged from the outlook of $14.6 billion revealed within the 2025 Budget.

Revenues in 2025–26 are projected to be $219.9 billion, unchanged from the 2025 Budget.

Program expense in 2025–26 is projected to be $216.3 billion, unchanged from the 2025 Budget.

Interest and Other Debt Servicing Charges in 2025–26 is projected to stay unchanged at $16.2 billion, as forecasted within the 2025 Budget.

The web debt-to-GDP ratio is projected to be 37.9 per cent in 2025–26, in line with the forecast within the 2025 Budget.

The 2025 Budget included a $2.0 billion reserve in 2025–26, to guard the fiscal outlook towards any unexpected modifications within the province’s income and expense forecasts. The $2.0 billion reserve has been maintained as half of the present fiscal outlook. The reserve supplies extra prudence within the authorities’s fiscal framework and is distinct from the Contingency Fund that gives devoted funding to be allotted in response to rising wants.

| Item | 2025 Budget | Current Outlook | In-Year Change |

|---|---|---|---|

| Revenue | 219,887 | 219,887 | – |

| Expense — Programs | 216,298 | 216,298 | – |

| Expense — Interest and Other Debt Servicing Charges | 16,198 | 16,198 | – |

| Total Expense | 232,497 | 232,497 | – |

| Surplus/(Deficit) Before Reserve | (12,609) | (12,609) | – |

| Reserve | 2,000 | 2,000 | – |

| Surplus/(Deficit) | (14,609) | (14,609) | – |

Notes: Numbers might not add attributable to rounding. Current outlook primarily displays data accessible as of June 30, 2025.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Revenue

The 2025–26 income outlook is projected to be $219.9 billion, unchanged from the 2025 Budget.

The income outlook relies on data accessible on the finish of the primary quarter of 2025–26. There are additional upside and draw back dangers that would materially have an effect on the income outlook. These embrace modifications to the financial development outlook, new data on tax assessments primarily based on 2024 and prior-year tax return filings acquired all through the summer time, and collections. The authorities will monitor these financial and income developments, and can present additional particulars in future fiscal updates as new data turns into accessible.

Expense

Total expense is projected to be $232.5 billion, unchanged from the 2025 Budget projection.

Program Expense Update

The 2025–26 complete program expense outlook, at $216.3 billion, is on observe with the projection within the 2025 Budget. The authorities continues to handle spending throughout the fiscal plan.

Interest and Other Debt Servicing Charges Update

Interest and Other Debt Servicing Charges is projected to be $16.2 billion, unchanged from the forecast within the 2025 Budget.

Fiscal Prudence

The Fiscal Sustainability, Transparency and Accountability Act, 2019 requires Ontario’s fiscal plan to include prudence within the type of a reserve to guard the fiscal outlook towards unexpected modifications within the province’s income and expense, together with these ensuing from Ontario’s financial efficiency. The 2025 Budget included a reserve of $2.0 billion in 2025–26, which has been maintained as half of the present fiscal outlook.

In addition, the Contingency Fund is maintained to assist mitigate expense dangers—for instance, in instances the place well being and security could also be compromised, or unexpected occasions which can in any other case adversely have an effect on Ontario’s fiscal efficiency. The present stability of the Contingency Fund is $3.0 billion for 2025–26.

Section B: Ontario’s Recent Economic Performance and Outlook

In the primary calendar quarter of 2025, Ontario’s actual gross home product (GDP) elevated by 0.6 per cent, matching development within the earlier quarter. Real GDP development within the first quarter was supported by larger exports and family spending.

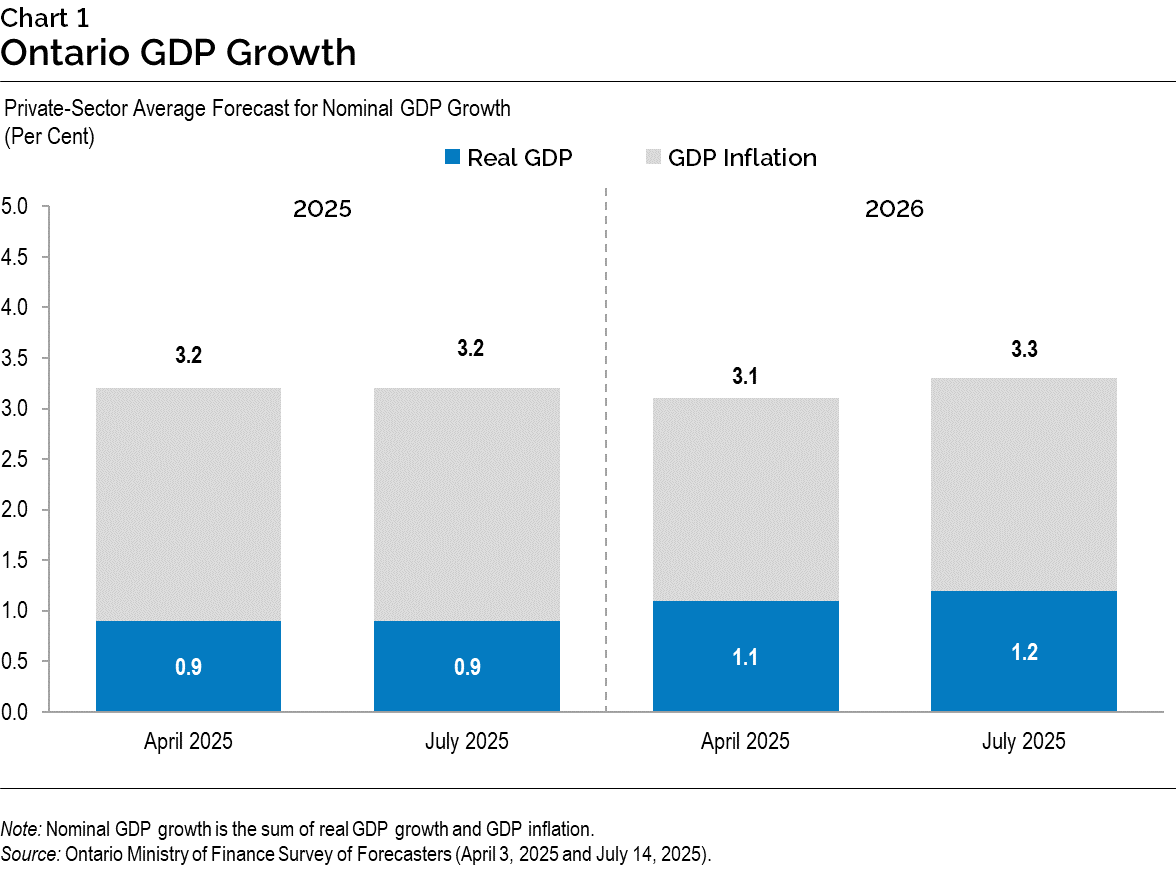

Since the discharge of the 2025 Budget, Ontario’s actual GDP development expectations from private-sector forecasters have, on common, remained little-changed. Private-sector forecasters, on common, venture Ontario’s actual GDP to rise by 0.9 per cent in 2025, the identical price projected on the time of the 2025 Budget. The private-sector common forecast for 2026 has been revised barely upward to 1.2 per cent from 1.1 per cent on the time of the 2025 Budget.

The private-sector common forecast for Ontario’s nominal GDP development for 2025 is 3.2 per cent, unchanged from the projection on the time of the 2025 Budget. The private-sector common forecast for 2026 has risen to three.3 per cent from 3.1 per cent on the time of the 2025 Budget.

Global financial development has been resilient, regardless of elevated uncertainty and shifting U.S. commerce coverage. The International Monetary Fund tasks international actual GDP to rise by 3.0 per cent in 2025 and three.1 per cent in 2026, in comparison with the projected will increase of two.8 per cent in 2025 and three.0 per cent in 2026 on the time of the 2025 Budget.

In the U.S., forecasters anticipate actual GDP to extend by 1.4 per cent in each 2025 and 2026, unchanged from development projections on the time of the 2025 Budget, in response to the Blue Chip Economic Indicators July survey.

Uncertainty associated to U.S. commerce coverage continues to impression the worldwide financial outlook. Ontario’s important buying and selling relationships with the United States current elevated dangers and uncertainty that are anticipated to weigh on shopper spending and enterprise funding choices over the near-term.

Consumer value inflation in superior economies has eased from latest highs, though sure value pressures stay persistent. Higher tariffs and potential provide chain disruptions might increase costs and immediate central banks to keep up larger rates of interest for longer.

Global conflicts proceed to boost dangers for key commodity markets, together with for vitality merchandise and international provide chains.

Section C: Details of Ontario’s Finances

| Item | 2025–26 2025 Budget |

2025–26 Current Outlook |

2025–26 In-Year Change |

|---|---|---|---|

| Taxation Revenue — Personal Income Tax | 57,811 | 57,811 | – |

| Taxation Revenue — Sales Tax | 40,073 | 40,073 | – |

| Taxation Revenue — Corporations Tax | 25,980 | 25,980 | – |

| Taxation Revenue — Education Property Tax | 5,853 | 5,853 | – |

| Taxation Revenue — Employer Health Tax | 9,466 | 9,466 | – |

| Taxation Revenue — Ontario Health Premium | 5,366 | 5,366 | – |

| Taxation Revenue — Gasoline Tax | 1,664 | 1,664 | – |

| Taxation Revenue — Land Transfer Tax | 3,875 | 3,875 | – |

| Taxation Revenue — Tobacco Tax | 667 | 667 | – |

| Taxation Revenue — Fuel Tax | 522 | 522 | – |

| Taxation Revenue — Beer, Wine and Spirits Taxes | 388 | 388 | – |

| Taxation Revenue — Electricity Payments in Lieu of Taxes | 634 | 634 | – |

| Taxation Revenue — Ontario Portion of the Federal Cannabis Excise Duty | 376 | 376 | – |

| Taxation Revenue — Other Taxes | 1,027 | 1,027 | – |

| Taxation Revenue — Total | 153,702 | 153,702 | – |

| Government of Canada — Canada Health Transfer | 21,332 | 21,332 | – |

| Government of Canada — Canada Social Transfer | 6,794 | 6,794 | – |

| Government of Canada — Equalization | 546 | 546 | – |

| Government of Canada — Infrastructure Programs | 1,055 | 1,055 | – |

| Government of Canada — Labour Market Programs | 923 | 923 | – |

| Government of Canada — Social Housing Agreement | 133 | 133 | – |

| Government of Canada — Other Federal Payments | 7,554 | 7,554 | – |

| Government of Canada — Direct Transfers to Broader Public Sector Organizations | 509 | 509 | – |

| Government of Canada — Total | 38,846 | 38,846 | – |

| Income from Government Business Enterprises — Liquor Control Board of Ontario | 1,851 | 1,851 | – |

| Income from Government Business Enterprises — Ontario Power Generation Inc./Hydro One Ltd. | 1,599 | 1,599 | – |

| Income from Government Business Enterprises — Ontario Lottery and Gaming Corporation | 2,405 | 2,405 | – |

| Income from Government Business Enterprises — Ontario Cannabis Store | 215 | 215 | – |

| Income from Government Business Enterprises — iGaming Ontario | 247 | 247 | – |

| Income from Government Business Enterprises — Total | 6,317 | 6,317 | – |

| Other Non-Tax Revenue — Fees, Donations and Other Revenues from Hospitals, School Boards and Colleges | 10,852 | 10,852 | – |

| Other Non-Tax Revenue — Vehicle and Driver Registration Fees | 1,242 | 1,242 | – |

| Other Non-Tax Revenue — Miscellaneous Other Non-Tax Revenue | 1,710 | 1,710 | – |

| Other Non-Tax Revenue — Other Fees and Licences | 1,874 | 1,874 | – |

| Other Non-Tax Revenue — Sales and Rentals | 1,964 | 1,964 | – |

| Other Non-Tax Revenue — Reimbursements | 1,074 | 1,074 | – |

| Other Non-Tax Revenue — Royalties | 309 | 309 | – |

| Other Non-Tax Revenue — Power Supply Contract Recoveries | 44 | 44 | – |

| Other Non-Tax Revenue — Interest and Investment Income | 1,953 | 1,953 | – |

| Other Non-Tax Revenue — Total | 21,022 | 21,022 | – |

| Total Revenue | 219,887 | 219,887 | – |

Notes: Numbers might not add attributable to rounding. Current outlook primarily displays data accessible as of June 30, 2025.

Source: Ontario Ministry of Finance.

| Ministry Expense | 2025–26 2025 Budget |

2025–26 Current Outlook |

2025–26 In-Year Change |

|---|---|---|---|

| Agriculture, Food and Agribusiness (Base) | 474.9 | 474.9 | – |

| Agriculture, Food and Agribusiness — Demand-Driven Risk Management and Time-Limited Programs | 575.3 | 575.3 | – |

| Agriculture, Food and Agribusiness (Total) | 1,050.1 | 1,050.1 | – |

| Attorney General (Base) | 2,274.4 | 2,274.4 | – |

| Attorney General — Bad Debt Expense | 5.3 | 5.3 | – |

| Attorney General (Total) | 2,279.7 | 2,279.7 | – |

| Board of Internal Economy (Total) | 352.2 | 352.2 | – |

| Children, Community and Social Services (Total) | 20,358.7 | 20,358.7 | – |

| Citizenship and Multiculturalism (Total) | 92.7 | 92.7 | – |

| Colleges, Universities, Research Excellence and Security (Base) | 11,462.7 | 11,462.7 | – |

| Colleges, Universities, Research Excellence and Security — Student Financial Assistance | 1,523.5 | 1,523.5 | – |

| Colleges, Universities, Research Excellence and Security (Total) | 12,986.2 | 12,986.2 | – |

| Economic Development, Job Creation and Trade (Base) | 205.8 | 205.8 | – |

| Economic Development, Job Creation and Trade — Tax Credits for Business Investment and Research and Development |

691.6 | 691.6 | – |

| Economic Development, Job Creation and Trade — Time-Limited Investments | 1,508.0 | 1,508.0 | – |

| Economic Development, Job Creation and Trade (Total) | 2,405.4 | 2,405.4 | – |

| Education (Base) | 40,987.4 | 40,987.4 | – |

| Education — Teachers’ Pension Plan | 1,733.0 | 1,733.0 | – |

| Education (Total) | 42,720.4 | 42,720.4 | – |

| Emergency Preparedness and Response (Total) | 66.2 | 66.2 | – |

| Energy and Mines (Base) | 661.5 | 661.5 | – |

| Energy and Mines — Electricity Cost Relief Programs | 6,463.0 | 6,463.0 | – |

| Energy and Mines — High-Speed Internet | 1,734.4 | 1,734.4 | – |

| Energy and Mines — Time-Limited Investments | 84.1 | 84.1 | – |

| Energy and Mines (Total) | 8,943.0 | 8,943.0 | – |

| Environment, Conservation and Parks (Total) | 1,041.8 | 1,041.8 | – |

| Executive Offices (Total) | 79.4 | 79.4 | – |

| Finance (Base) | 1,163.3 | 1,163.3 | – |

| Finance — Investment Management Corporation of Ontario | 330.1 | 330.1 | – |

| Finance — Ontario Municipal Partnership Fund | 562.5 | 562.5 | – |

| Finance — Temporary and Other Local Assistance | 21.1 | 21.1 | – |

| Finance — Power Supply Contract Costs | 44.1 | 44.1 | – |

| Finance — Time-Limited Investments | 52.5 | 52.5 | – |

| Finance (Total) | 2,173.6 | 2,173.6 | – |

| Francophone Affairs (Base) | 8.7 | 8.7 | – |

| Francophone Affairs — Time-Limited Investments | 2.6 | 2.6 | – |

| Francophone Affairs (Total) | 11.3 | 11.3 | – |

| Health (Total) | 81,851.6 | 81,851.6 | – |

| Indigenous Affairs and First Nations Economic Reconciliation (Total) | 144.8 | 144.8 | – |

| Infrastructure (Base) | 747.0 | 747.0 | – |

| Infrastructure — Federal–Provincial Infrastructure Programs | 213.6 | 213.6 | – |

| Infrastructure — Waterfront Toronto Revitalization (Port Lands Flood Protection) | 32.5 | 32.5 | – |

| Infrastructure — Municipal Infrastructure Program Investments | 1,243.9 | 1,243.9 | – |

| Infrastructure — Realty | 1,437.6 | 1,437.6 | – |

| Infrastructure (Total) | 3,674.7 | 3,674.7 | – |

| Labour, Immigration, Training and Skills Development (Base) | 160.0 | 160.0 | – |

| Labour, Immigration, Training and Skills Development — Co-operative Education Tax Credit | 102.5 | 102.5 | – |

| Labour, Immigration, Training and Skills Development — Demand-Driven Employment and Training Programs | 1,840.2 | 1,840.2 | – |

| Labour, Immigration, Training and Skills Development (Total) | 2,102.7 | 2,102.7 | – |

| Long-Term Care (Total) |

9,279.3 | 9,279.3 | – |

| Municipal Affairs and Housing (Base) | 798.5 | 798.5 | – |

| Municipal Affairs and Housing — Time-Limited Investments | 830.7 | 830.7 | – |

| Municipal Affairs and Housing — Social Housing Agreement – Payments to Service Managers | 128.3 | 128.3 | – |

| Municipal Affairs and Housing (Total) | 1,757.4 | 1,757.4 | – |

| Natural Resources (Base) | 740.4 | 740.4 | – |

| Natural Resources — Emergency Forest Firefighting | 135.0 | 135.0 | – |

| Natural Resources (Total) | 875.4 | 875.4 | – |

| Northern Economic Development and Growth (Total) | 805.2 | 805.2 | – |

| Public and Business Service Delivery and Procurement (Total) | 1,712.3 | 1,712.3 | – |

| Rural Affairs (Base) | 14.3 | 14.3 | – |

| Rural Affairs — Time-Limited Investments | 5.0 | 5.0 | – |

| Rural Affairs (Total) | 19.3 | 19.3 | – |

| Seniors and Accessibility (Base) | 76.8 | 76.8 | – |

| Seniors and Accessibility — Seniors Tax Credit | 104.3 | 104.3 | – |

| Seniors and Accessibility (Total) | 181.1 | 181.1 | – |

| Solicitor General (Total) | 4,463.0 | 4,463.0 | – |

| Sport (Base) | 62.9 | 62.9 | – |

| Sport — Time-Limited Investments | 150.0 | 150.0 | – |

| Sport (Total) | 212.9 | 212.9 | – |

| Tourism, Culture and Gaming (Base) | 869.2 | 869.2 | – |

| Tourism, Culture and Gaming — Ontario Cultural Media Tax Credits | 1,028.4 | 1,028.4 | – |

| Tourism, Culture and Gaming (Total) | 1,897.6 | 1,897.6 | – |

| Transportation (Base) | 7,198.6 | 7,198.6 | – |

| Transportation — Federal–Provincial Infrastructure Programs | 629.9 | 629.9 | – |

| Transportation (Total) | 7,828.6 | 7,828.6 | – |

| Treasury Board Secretariat (Base) | 403.9 | 403.9 | – |

| Treasury Board Secretariat — Employee and Pensioner Benefits | 1,528.0 | 1,528.0 | – |

| Treasury Board Secretariat — Operating Contingency Fund | 2,825.0 | 2,825.0 | – |

| Treasury Board Secretariat — Capital Contingency Fund | 175.0 | 175.0 | – |

| Treasury Board Secretariat (Total) | 4,931.9 | 4,931.9 | – |

| Interest and Other Debt Servicing Charges |

16,198.1 | 16,198.1 | – |

| Total Expense | 232,496.6 | 232,496.6 | – |

Notes: Numbers might not add attributable to rounding. Current outlook primarily displays data accessible as of June 30, 2025.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

| Sector | 2025–26 Current Outlook Investment in Capital Assets |

2025–26 Current Outlook Transfers and Other Infrastructure Expenditures |

2025–26 Current Outlook Total Infrastructure Expenditures |

2025 Budget Total Infrastructure Expenditures |

In-Year Change Total Infrastructure Expenditures |

|---|---|---|---|---|---|

| Transportation — Transit | 9,671 | 1,079 | 10,749 | 10,749 | – |

| Transportation — Provincial Highways | 3,864 | 395 | 4,259 | 4,259 | – |

| Transportation — Other Transportation, Property and Planning | 177 | 145 | 321 | 321 | – |

| Health — Hospitals | 4,455 | 15 | 4,470 | 4,470 | – |

| Health — Other Health | 53 | 679 | 732 | 732 | – |

| Education | 3,957 | 260 | 4,216 | 4,216 | – |

| Postsecondary Education — Colleges and Other | 636 | 72 | 708 | 708 | – |

| Postsecondary Education — Universities | – | 185 | 185 | 185 | – |

| Social | 32 | 613 | 644 | 644 | – |

| Justice | 936 | 37 | 973 | 973 | – |

| Other Sectors |

3,323 | 4,455 | 7,778 | 7,778 | – |

| Total Infrastructure Expenditures | 27,103 | 7,934 | 35,037 | 35,037 | – |

| Less: Other Partner Funding |

1,690 | – | 1,690 | 1,690 | – |

| Total |

25,412 | 7,934 | 33,346 | 33,346 | – |

Notes: Numbers might not add attributable to rounding. Current outlook primarily displays data accessible as of June 30, 2025.

Source: Ontario Treasury Board Secretariat.

| Item | Actual 2021–22 |

Actual 2022–23 |

Actual 2023–24 |

Interim 2024–25 |

Current Outlook 2025–26 |

|---|---|---|---|---|---|

| Revenue | 185,847 | 194,431 | 209,021 | 221,602 | 219,887 |

| Expense — Programs | 170,520 | 186,364 | 195,207 | 212,374 | 216,298 |

| Expense — Interest and Other Debt Servicing Charges |

13,302 | 13,935 | 14,461 | 15,224 | 16,198 |

| Total Expense | 183,822 | 200,299 | 209,668 | 227,598 | 232,497 |

| Reserve | – | – | – | – | 2,000 |

| Surplus/(Deficit) | 2,025 | (5,868) | (647) | (5,996) | (14,609) |

| Net Debt | 382,842 | 399,806 | 407,969 | 428,125 | 460,758 |

| Accumulated Deficit | 238,160 | 246,007 | 244,309 | 250,305 | 264,914 |

| Gross Domestic Product (GDP) at Market Prices | 970,146 | 1,061,714 | 1,119,545 | 1,178,353 | 1,214,882 |

| Primary Household Income | 642,144 | 692,033 | 736,585 | 791,627 | 823,292 |

| Population — July (000s) |

14,842 | 15,141 | 15,623 | 16,124 | 16,348 |

| Net Debt Per Capita ({dollars}) | 25,794 | 26,405 | 26,113 | 26,552 | 28,184 |

| Household Income Per Capita ({dollars}) | 43,264 | 45,705 | 47,147 | 49,033 | 50,359 |

| Net Debt as a Per Cent of Operating Revenue | 206.8% | 207.3% | 198.1% | 195.4% | 211.4% |

| Net Interest as a Per Cent of Operating Revenue | 6.8% | 6.4% | 5.5% | 5.8% | 6.5% |

| Net Debt as a Per Cent of GDP | 39.5% | 37.7% | 36.4% | 36.3% | 37.9% |

| Accumulated Deficit as a Per Cent of GDP | 24.5% | 23.2% | 21.8% | 21.2% | 21.8% |

Notes: Numbers might not add attributable to rounding. Current outlook primarily displays data accessible as of June 30, 2025.

Sources: Statistics Canada, Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Section D: Ontario’s 2025–26 Borrowing Program

| Item | 2025–26 2025 Budget |

2025–26 Current Outlook |

2025–26 Change from 2025 Budget |

|---|---|---|---|

| Deficit/(Surplus) | 14.6 | 14.6 | – |

| Provincial Investment in Capital Assets | 23.1 | 23.1 | – |

| Amortization of Capital Assets | (9.1) | (9.1) | – |

| Non-Cash and Cash Timing Adjustments | (3.1) | (3.1) | – |

| Net Loans and Investments | 1.2 | 1.2 | – |

| Debt Maturities and Redemptions | 33.1 | 33.1 | – |

| Total Funding Requirement | 59.8 | 59.8 | – |

| Decrease/(Increase) in Short-Term Borrowing | (5.0) | (5.0) | – |

| Increase/(Decrease) in Year-End Cash and Cash Equivalents | (12.0) | (12.0) | – |

| Total Long-Term Public Borrowing | 42.8 | 42.8 | – |

Note: Numbers might not add attributable to rounding.

Source: Ontario Financing Authority.

Ontario’s present funding necessities and long-term borrowing for 2025–26 are projected to stay unchanged from the forecast within the 2025 Budget.

As of July 31, 2025, Ontario had accomplished $20.9 billion or 48.9 per cent of its $42.8 billion 2025–26 lengthy‑time period borrowing program. Approximately $14.3 billion or 68.5 per cent was accomplished in Canadian {dollars}, with the remaining $6.6 billion or 31.5 per cent accomplished primarily in U.S. {dollars} and euros.

Green Bonds stay a core part of Ontario’s borrowing program and are an necessary device to assist finance public transit initiatives, excessive weather-resilient infrastructure, in addition to vitality effectivity and conservation tasks. Ontario stays the most important issuer of Canadian greenback Green Bonds, totalling $21.5 billion issued since 2014–15, with $16.8 billion excellent.

Ontario plans to proceed its management within the Canadian greenback Green Bond market and, topic to market situations, will concern a number of Green Bonds every fiscal yr, together with in 2025–26.

Ontario’s price of borrowing for 2025–26 stays at 4.0 per cent, as long-term charges have remained throughout the vary forecasted within the 2025 Budget by the primary quarter. The province will proceed to observe actions in rates of interest and supply common updates on the Interest and Other Debt Servicing Charges expense in future fiscal updates.

2025–26 Long-Term Borrowing

| Item | Amount |

|---|---|

| Canadian Dollar Issues | 14.3 |

| Foreign Currency Issues | 6.6 |

| Total | 20.9 |

Notes: Numbers might not add attributable to rounding. As of July 31, 2025.

Source: Ontario Financing Authority.

Ministry of Finance: www.ontario.ca/finance

For basic inquiries relating to the 2025–26 First Quarter Finances, please name or e mail:

Toll-free English and French inquiries:

Teletypewriter:

Email: [email protected]

© King’s Printer for Ontario, 2025

Chart Descriptions: Alternative Text for Web Accessibility

Chart 1: Ontario GDP Growth

This stacked bar chart reveals private-sector common forecasts in April 2025 and July 2025 for Ontario actual GDP development, GDP inflation and nominal GDP development in 2025 and 2026. Note that nominal GDP development is the sum of actual GDP development and GDP inflation.

In April 2025, the common of private-sector forecasts projected Ontario’s actual GDP to rise by 0.9 per cent in 2025 and nominal GDP to extend by 3.2 per cent. For 2026, actual GDP was projected to rise by 1.1 per cent and nominal GDP to develop by 3.1 per cent.

In July 2025, the common of private-sector forecasts tasks Ontario’s actual GDP to rise by 0.9 per cent in 2025 and nominal GDP to develop by 3.2 per cent. For 2026, actual GDP is projected to rise by 1.2 per cent and nominal GDP to extend by 3.3 per cent.

Source: Ontario Ministry of Finance Survey of Forecasters (April 3, 2025 and July 14, 2025).

This web page was created programmatically, to learn the article in its authentic location you possibly can go to the hyperlink bellow:

https://www.ontario.ca/page/2025-26-first-quarter-finances

and if you wish to take away this text from our web site please contact us