This web page was created programmatically, to learn the article in its authentic location you possibly can go to the hyperlink bellow:

https://m.economictimes.com/wealth/borrow/how-real-money-gaming-addiction-dragged-thousands-of-people-into-debt-crisis/articleshow/124011010.cms

and if you wish to take away this text from our web site please contact us

Today, Gupta, 38, is saddled with over Rs.1 crore in debt, completely in her title, but none of her selecting. She is among the many hidden casualties of India’s Real Money Gaming (RMG) growth, the place spouses, dad and mom, and households develop into unwilling victims of addictions that may spiral from Rs.100 each day bets to crippling debt inside months.

In Delhi, 27-year-old Ravi Kumar (title modified on request) squandered Rs.18 lakh in simply 12 months on platforms like Stake, Mahadev, and Dream11. His journey from incomes Rs.40,000 a month as an insurance coverage worker to shouldering 12 completely different loans exhibits how rapidly leisure gaming can spiral into monetary destroy. “I kept convincing myself that another win would fix everything,” Kumar says. The huge win by no means got here.

Their tales are a part of a staggering nationwide disaster. As per business estimates, 45 crore Indians have misplaced over Rs.20,000 crore on on-line RMG platforms. These losses have triggered a cascade of penalties, from home violence to suicide threats, finally prompting authorities intervention.

The Central authorities’s current ban on RMGs seeks to slam shut a digital Pandora’s field, however for hundreds of debt-ridden households, the harm is finished. Behind the colorful interfaces, dopamine-triggering sound results, and guarantees of straightforward cash lies a fastidiously engineered system designed to maintain gamers betting till they lose all. Here is a take a look at how video games constructed to final minutes created money owed that linger for years—and the determined scramble to interrupt free.

Descent into debt

Gupta’s nightmare didn’t begin with that September bank card assertion. It started a few years earlier, with small requests for cash from her husband, who, regardless of having an everyday job, by no means contributed financially to operating the family. He first began enjoying on-line video games round 2018 utilizing his personal cash. When Covid-19 set in 2020, his agency’s exercise dropped considerably, and he discovered himself at residence more often than not: that’s when his dependancy to on-line gaming took root. He first started borrowing from his buddies, after which from his spouse. What began off with Rs.5,000-10,000 at a time quickly escalated to Gupta’s husband taking practically 70% of her month-to-month wage. He cited Covid-induced unemployment and his dad and mom’ medical expenses as excuses. She later found he had been playing away the cash or spending it on his household’s lavish life-style of their hometown.

ROMIL MEHTA, LEGAL COUNSEL

Note:“If someone is deeply in debt, recovery is difficult. Remember, sometimes you win, but mostly you learn.”

As her husband sank deeper into on-line playing, Gupta’s life took a flip for the more serious in 2022: she had unknowingly drained most of her financial savings to fund his dependancy. He then coerced her to take a Rs.10 lakh mortgage on his behalf, claiming he wanted it to repay money owed from his dad and mom’ hospitalisation in the course of the lockdown, and emotionally blackmailed her with warnings of collectors at their door. Six months later, he cajoled his spouse into yet one more Rs.10 lakh mortgage for him. She nonetheless didn’t find out about his playing dependancy; he would depart in the course of the day on the pretext of caring for his dad and mom, who lived elsewhere, and would return at night time. “I realised much later that he would come to me only for the money,” Gupta informed ET Wealth over a telephone name.

Ravi Kumar, 27

Addicted to on-line gaming.

Salary on the time of dependancy: Rs.40,000

Gaming apps used: Stake, Cricbet, Mahadev, Zupee, My11Circle, Dream 11

Debt remaining: Rs.4 lakh

Squandered on gaming: Rs.18 lakh

Total debt:Rs.19 lakh roughly.

Loans taken from: Friends, banks, mortgage apps, household, gold loans

The lure of quick life-style upgrades drew Kumar to on-line gaming.

She lastly came upon about her husband’s on-line gaming dependancy in 2023. He largely gambled on Dafabet, a Philippines-based gaming app. Apart from repeated arguments and even bodily assaults when she resisted, he would use emotional manipulation to bully her into taking loans from banks, fintech corporations, and different lenders. Between 2022 and 2023, beneath strain from her husband, she took Rs.30 lakh of loans, clinging to his hole assurances that he would change. All this whereas, her conniving husband had been exploiting his job at a mortgage processing centre to rig the system and divert her mortgage functions to himself. This was aside from the gold her in-laws took from her after forcing her out of the home in 2020, simply two years into the wedding.

The couple finally separated, and the husband is but to recuperate from his playing behavior. Despite settling loans value Rs.30 lakh, she nonetheless had Rs.1.07 crore throughout six completely different loans. Of this quantity, practically Rs.95 lakh stays excellent. Against a month-to-month wage of Rs.1.9 lakh, her equated month-to-month instalment is Rs.2.8 lakh. “My savings have been wiped out. Since all the loans are in my name, I have to clear the debt somehow,” says the distraught spouse, who spends practically Rs.1 lakh each six months for her daughter’s medical therapy. She says she might need to borrow from her household to repay her money owed.

Dreams to mud

Gaming developed from easy leisure— Nineteen Eighties handhelds, console cartridges, and cellular video games like Snake—to stylish psychological manipulation. The ultimate shift got here with RMGs in 2019-20, which weaponised engagement strategies to extract cash; the Covid lockdown accelerated this evolution.

Experts say that the federal government’s ban on RMGs seems properly thought out, neatly bypassing the long-standing chance-versusskill debate. “Banning RMGs was necessary before more players lost money. It’s commendable that the government has chosen to uphold moral standards over chasing tax revenues,” says Romil Mehta, authorized counsel at a online game firm.

An August 2025 Angel One report says that the RMG sector contributes Rs.20,000-25,000 crore yearly in direct and oblique taxes. But Mehta argues that RMG is extremely addictive. “The more you win, the more you want to play; chasing losses is the quickest way to lose even more.”

Delhi-based Kumar is aware of this all too properly. Swayed by the flashy existence of his colleagues and buddies, he craved extra from life, and quick. A wage of Rs.40,000 a month in his mid-twenties wasn’t sufficient. What began with small bets of `100 a day on betting apps and Rs.2,000 per wager, not lengthy after that, Kumar’s total wage and his financial savings, which had amassed to Rs.70,000-80,000, disappeared in a flash. “It was a thrill, a quick escape from reality, and for a while, it felt like the key to the lifestyle I craved,” he says. The wins had been fleeting, the losses had been devastating.

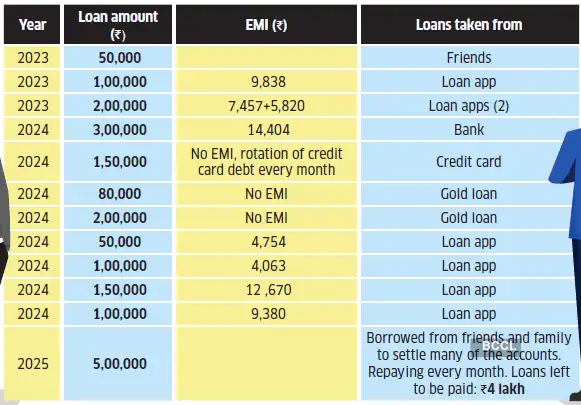

The one-more-win mindset spiralled right into a vicious cycle, the place he stored on shedding cash to the tune of Rs.40,000-50,000. More money owed led to extra loans, and extra EMIs. To repay these, he performed extra, and sadly, stored shedding. Eventually, when mortgage restoration brokers got here to his doorstep and threatened him and his household, Kumar realised issues had gone too far. Driven by his want for gaming, he had borrowed near Rs.20 lakh throughout 12 loans, from banks, a mortgage app, and had additionally pledged his household’s gold. He is but to repay Rs.4 lakh; the remainder has been settled.

Bells and whistles

Aside from the greed to make more cash, why do players really feel hooked on on-line video games? This is as a result of on-line video games use a mixture of vivid colors, enticing designs and visible attraction to maintain the gamers engaged. Farhan, a sport developer and a current pc science graduate, says {that a} sport’s main purpose is to maintain the participant engaged and never make him depart. The method to try this is by triggering the discharge of dopamine, a mind chemical that creates a way of reward and pleasure. Farhan explains that elaborate visible and audio suggestions is all the pieces in RMGs. Instead of a easy ‘Congratulations, you won’ pop-ups, these platforms bombard gamers with trumpets blaring, confetti exploding throughout screens, money register sounds, coin-falling animations, telephone vibrations, and a number of congratulatory messages, all designed to make even small wins really feel monumental. “As a player, you feel, ‘Oh wow, I just did something big. I want to do it again’,” he says. This psychological manipulation by means of “bells and whistles” retains gamers engaged even when they’re shedding cash, as a result of their brains affiliate the sensory overload with large success. “The game has to feel rewarding even if you are not actually doing anything,” he provides.

How the debt lure works

As EMIs went up and losses mounted, Ravi Kumar continued to borrow cash.

That’s not all. Like many e-commerce web sites, on-line gaming websites additionally deploy psychological tips, extra generally known as darkish patterns, within the digital world. These are misleading internet designs that on-line web sites use to govern customers into doing issues they may not do in any other case. They goal to govern your behaviour.

“The apps were designed to keep me hooked. They’d give small wins to keep my hope alive, but whenever I tried to withdraw a significant amount, my bets would fail. When I’d stop playing, a notification would pop-up: ‘Mr X just won Rs.12 lakh on the same bet you considered.’ It were such psychological tricks, making me believe I was just minutes away from a huge win, that kept me addicted,” says Kumar. Farhan provides that many gaming apps let you begin a brand new sport on the click on of a button. But if you wish to exit and take your wins off the desk, “they make you go through multiple buttons and use colour tricks to keep the exit button away from your gaze.”

Stuck in debt

Debt counsellors say that within the absence of particular person chapter legal guidelines, folks should repay their loans. But greater than repaying the loans, it’s the harassment that takes a toll. “Our first goal is to get the banks and lenders stop the recovery agents from chasing the debtors,” says Ritesh Srivastava, Founder and CEO, FREED.

Once threatening calls cease, debt counsellors concentrate on settlement methods. FREED units up escrow accounts the place debtors put aside month-to-month quantities in professionally managed trusts. A Delhi-based debt counselling agency deploys round 100 advocates who talk with banks, reply to authorized notices and assist thrust back restoration brokers. Once loans stay unpaid for 90 days and switch into Non-Performing Assets (NPAs), banks usually realise that settling is best than promoting them to asset reconstruction corporations for a pittance. “We work with debtors to build solid evidence of their inability to repay. When you take the legal route to prove this, banks eventually listen,” says a debt counsellor who didn’t need to be named.

“In the US, nearly 7-9% of debt enrolled comes purely from gambling and betting, which is a regulated industry there. Until the RMG ban, India was showing similar patterns, only without the safety nets.”

RITESH SRIVASTAVA

FOUNDER AND CEO,FREED

Both Srivastava and Mehta say misery calls from individuals who’ve misplaced in RMGs have steadily elevated. “The problem is serious, and many players do not realise their situation until they lose big amounts. There are stories of players begging customer support to return lost money, threatening selfharm, or losing their savings meant for children’s education and marriage,” says Mehta.

Rama Gupta, 38

Victim of husband’s on-line gaming dependancy.

Loans taken: Rs.1.07 crore

Betting app: Dafabet

Debt remaining: Rs.95 lakh

Income: Rs.1.9 lakh month-to-month

Loans paid of: Rs.12.56 lakh

Gupta took the loans on behalf of her husband, who was hooked on on-line playing

Primary motive behind the loans was to clear money owed that her husband had taken from buddies and native sellers.

How to identify & cease dependancy

Srivastava says {that a} sudden spike in unidentified bills could be a clue that one thing’s amiss. You ought to keep away from dipping into long-term investments just like the Employee’s Provident Fund (EPF), until it’s an absolute emergency. If you are ready to navigate the a number of hoops the EPFO requires to launch funds, ensure it’s not out of desperation for the flawed causes. Gupta put an excessive amount of religion in her husband and didn’t thoughts giving him greater than half of her wage. Unless it’s a one-off case and you’re satisfied of the rationale, keep away from such transactions and favours, and search assist.

This web page was created programmatically, to learn the article in its authentic location you possibly can go to the hyperlink bellow:

https://m.economictimes.com/wealth/borrow/how-real-money-gaming-addiction-dragged-thousands-of-people-into-debt-crisis/articleshow/124011010.cms

and if you wish to take away this text from our web site please contact us