This web page was created programmatically, to learn the article in its authentic location you’ll be able to go to the hyperlink bellow:

https://simplywall.st/stocks/us/consumer-services/nyse-hlt/hilton-worldwide-holdings/news/does-hiltons-hlt-lifestyle-brand-expansion-reveal-a-shift-in

and if you wish to take away this text from our website please contact us

- Earlier this month, Hilton introduced the launch of its twenty fifth model, Outset Collection by Hilton, increasing its life-style resort lineup, and in addition celebrated the latest opening of The George at Columbia, a brand new Tapestry Collection resort in Harlem that includes 139 rooms and a number of other upcoming facilities.

- These developments spotlight Hilton’s push into boutique and impartial resort experiences, aiming to broaden its buyer base and enhance its footprint in rising city and culturally important neighborhoods.

- Next, we’ll discover how Hilton’s model enlargement and new Harlem property might reinforce its funding narrative targeted on pipeline progress and life-style choices.

Trump has pledged to “unleash” American oil and fuel and these 22 US shares have developments which are poised to profit.

Hilton Worldwide Holdings Investment Narrative Recap

To be a Hilton shareholder as we speak, you typically must imagine within the firm’s potential to develop by model innovation, life-style choices, and world pipeline enlargement, with restoration in RevPAR and resilience in key demand segments as pivotal short-term catalysts. The latest launches of Outset Collection and The George at Columbia reinforce Hilton’s deal with high-value city markets and experiential stays, however these bulletins don’t materially change present dangers tied to sector RevPAR softness and potential demand shifts.

Of the newest bulletins, the launch of Outset Collection stands out as straight aligned with Hilton’s push into the life-style phase, which is considered one of traders’ clearest progress catalysts. This additional broadens Hilton’s capability to enchantment to vacationers looking for distinctive experiences, supporting pipeline momentum and Hilton Honors loyalty engagement at a time when aggressive depth and capital allocation dangers stay elevated.

However, traders also needs to be alert to 1 crucial issue: any extended softness in RevPAR that will…

Read the complete narrative on Hilton Worldwide Holdings (it is free!)

Hilton Worldwide Holdings is anticipated to achieve $14.8 billion in income and $2.5 billion in earnings by 2028. This outlook assumes a income progress charge of 45.4% per 12 months and a $0.9 billion enhance in earnings from the present $1.6 billion stage.

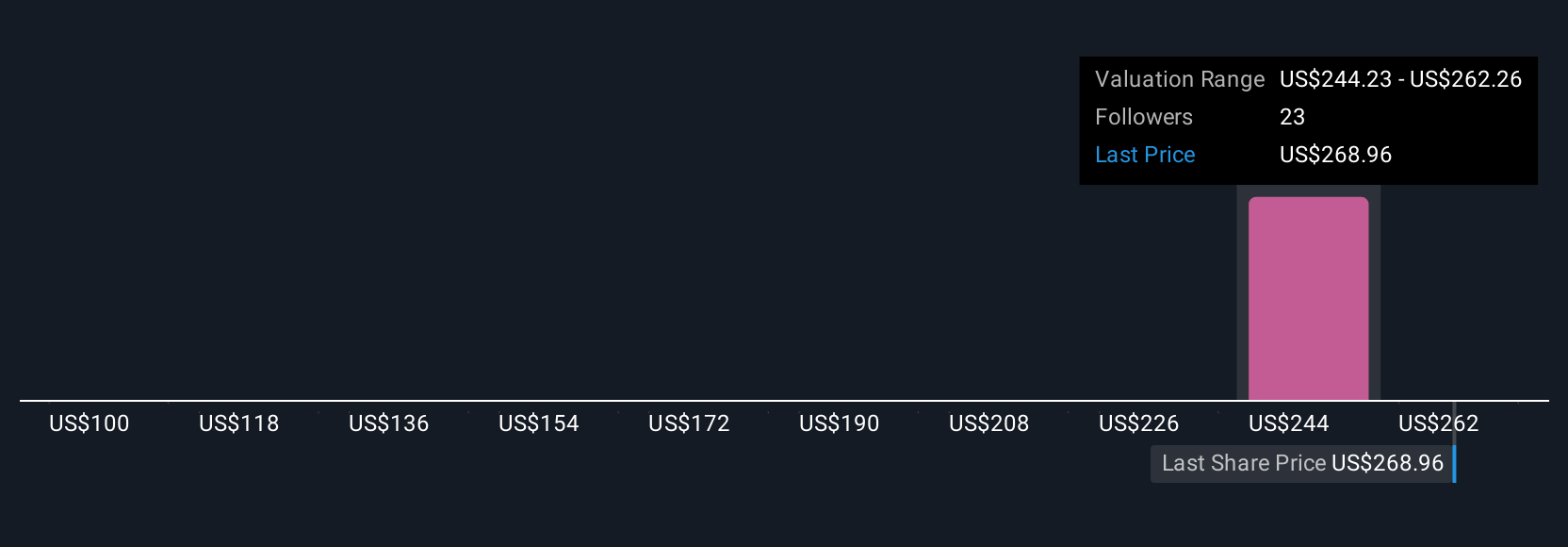

Uncover how Hilton Worldwide Holdings’ forecasts yield a $276.00 honest worth, a 6% upside to its present worth.

Exploring Other Perspectives

Two Simply Wall St Community members put Hilton’s honest worth between US$276.00 and US$280.29 per share. While many see model enlargement as a strong earnings catalyst, others counsel that persistent income pressures might weigh on Hilton’s market efficiency; discover a number of viewpoints earlier than forming your individual outlook.

Explore 2 different honest worth estimates on Hilton Worldwide Holdings – why the inventory may be value simply $276.00!

Build Your Own Hilton Worldwide Holdings Narrative

Disagree with present narratives? Create your individual in underneath 3 minutes – extraordinary funding returns hardly ever come from following the herd.

Curious About Other Options?

These shares are moving-our evaluation flagged them as we speak. Act quick earlier than the worth catches up:

This article by Simply Wall St is common in nature. We present commentary primarily based on historic information

and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your

monetary state of affairs. We purpose to deliver you long-term targeted evaluation pushed by basic information.

Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials.

Simply Wall St has no place in any shares talked about.

Valuation is advanced, however we’re right here to simplify it.

Discover if Hilton Worldwide Holdings may be undervalued or overvalued with our detailed evaluation, that includes honest worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Access Free Analysis

Have suggestions on this text? Concerned concerning the content material? Get in contact with us straight. Alternatively, e-mail [email protected]

This web page was created programmatically, to learn the article in its authentic location you’ll be able to go to the hyperlink bellow:

https://simplywall.st/stocks/us/consumer-services/nyse-hlt/hilton-worldwide-holdings/news/does-hiltons-hlt-lifestyle-brand-expansion-reveal-a-shift-in

and if you wish to take away this text from our website please contact us