This web page was created programmatically, to learn the article in its unique location you’ll be able to go to the hyperlink bellow:

https://www.phocuswire.com/travel-startups-2025-phocuswright-research

and if you wish to take away this text from our web site please contact us

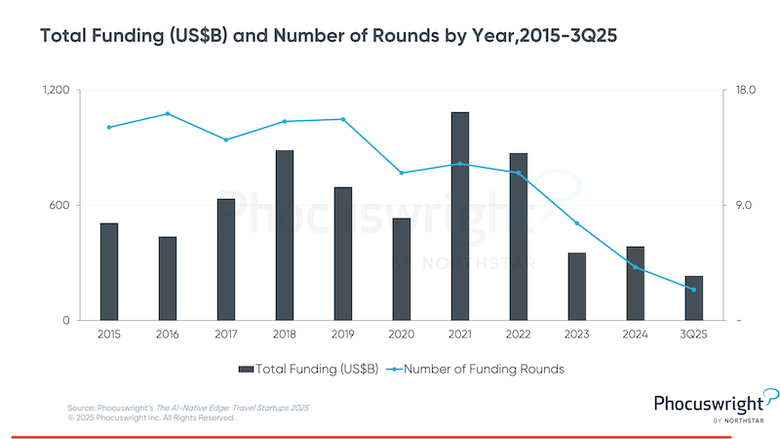

After two years of funding contraction, 2025 is shaping as much as be one other difficult yr for journey startups.

Meanwhile, synthetic intelligence (AI) is transferring from promise to observe. New entrants are sometimes AI-native, constructing leaner merchandise with smaller groups and quicker cycles than their predecessors might think about.

At the identical time, incumbents aren’t sitting nonetheless: They’re retrofitting legacy platforms for the AI period. And buyers are recalibrating. They know that technical moats not assure defensibility, and distribution and buyer entry are regaining primacy of their minds.

For founders, AI represents each alternative and threat. It lowers obstacles to entry, enabling younger corporations to achieve income quicker, but it surely additionally floods the market with opponents. For buyers, it calls for sharper self-discipline than ever, together with separating sustainable progress from froth, rewarding enterprise fashions that may resolve actual issues for years to come back and searching forward in an exit surroundings that’s nonetheless constrained.

This yr’s report, Phocuswright’s The AI-Native Edge: Travel Startups 2025, attracts on Phocuswright’s proprietary database of more than 8,000 companies and a world survey of 150 founders. Together, these knowledge factors present a candid image of the place the sector stands: undercapitalized and overhyped however filled with optimism.

Just as previous downturns set the stage for the following wave of class leaders, at the moment’s uncertainty could show to be fertile floor for the journey disruptors of tomorrow.

Investors are sitting tight

Investors are nonetheless in a wait-and-see interval proper now. The future is thrilling however formidable with all of the uncertainty that abounds. Stakeholders are attempting to grasp what’s coming with AI, along with navigating monetary and financial variables. But uncertainty and dramatic adjustments have at all times created dramatic alternatives, and there are good causes to consider that journey startup funding will rise dramatically as soon as once more, even when it’s extra unfold out.

In a September 2025 interview with PhocusWire, Chris Hemmeter, co-founder and managing accomplice at Thayer Investment Partners (beforehand talked about as #1 in PhocusWire’s Top Investors in Travel Tech in 2025), confirmed an acceptable adjustment of their investing technique.

“We have adopted a strategy that we call construct and convict. We find a number of early-stage experiments and make smaller investments in those companies to get a seat at the table. Typically what happens is a subset of those companies begin to take off. That’s when we come in with our conviction checks, which are much larger. We’re about to start investing out of our fifth fund and we expect to have between 40 and 50 portfolio companies in this fund,” Hemmeter mentioned.

Most entrepreneurs are optimistic about their future, particularly relating to progress. Only 5% anticipate progress below 10% in 2026, and almost a 3rd (27%) anticipate better than 100% progress. Whether this may translate into enterprise capital (VC)-funded alternatives is a large query.

What concerning the finish aim for each startups and buyers? The largest share of startups (37%) is hoping to be acquired by a journey business firm akin to a web-based journey company, resort chain or airline. Sixteen p.c hope to go public in an preliminary public providing. Twenty-four p.c are aiming for an acquisition or exit of $10-$50 million, whereas one fifth are aiming for $100-$500 million and 17% are on the lookout for an exit of greater than $1 billion. For 42%, their most well-liked timeline for an final result is three to 5 years.

These are life like expectations, particularly within the AI period. The basic downturn in VC over the previous few years, along with the rise of AI, has led to the popularization of “seed-strapping,” the concept of utilizing AI to scale rapidly to profitability and even an exit based mostly on a single funding spherical. Some of the touted advantages embody founders retaining bigger shares of their corporations, incurring fewer sunk prices and never having to remain on the VC treadmill.

If AI allows an explosion of seed-strapped corporations, concepts ought to proliferate and lots of smaller companies shall be constructed. This is probably not splendid for VCs, who have to kind by means of the noise to determine potential giant outcomes. But it may very well be good news for acquirers trying to fold in strategic acquisitions, in addition to for founders, who can nonetheless obtain life-changing outcomes even with out billion-dollar valuations.

In brief, AI could redefine not solely how journey startups are constructed however how “success” is outlined.

New this yr…

Phocuswright’s annual startups report now options an AI-powered chatbot that may assist reply your particular questions and pinpoint vital, topical analysis findings. Click “View” to attempt it within the full report.

This web page was created programmatically, to learn the article in its unique location you’ll be able to go to the hyperlink bellow:

https://www.phocuswire.com/travel-startups-2025-phocuswright-research

and if you wish to take away this text from our web site please contact us