This web page was created programmatically, to learn the article in its unique location you’ll be able to go to the hyperlink bellow:

https://www.nasdaq.com/articles/can-tractor-supplys-rural-lifestyle-demand-offset-cost-pressures

and if you wish to take away this text from our website please contact us

Tractor Supply Company, Inc. TSCO has demonstrated resilience in managing rising provide prices by leveraging robust demand for rural life. In third-quarter 2025, the corporate achieved a 7.2% year-over-year enhance in revenues, reaching $3.72 billion. Demand throughout core consumable, usable, and edible classes remained resilient, delivering regular transaction development and reinforcing the soundness of Tractor Supply’s buyer base. As a end result, comparable gross sales improved 3.9%, with transaction development of two.7%.

The firm highlighted document ranges of buyer engagement, together with rising loyalty program participation and constantly bettering satisfaction scores, indicating a wholesome and dedicated shopper cohort.

This regular demand helped counterbalance the consequences of upper product, transportation, and tariff-related prices flowing by means of the P&L. Management famous that modest pricing actions and a steady commodity price atmosphere supported a slight gross margin growth of 15 foundation factors to 37.4%, reflecting disciplined price administration and robust execution throughout merchandising and provide chain operations.

The firm skilled record-high buyer metrics for the third quarter, with the Neighbour’s Club accounting for greater than 80% of gross sales and exhibiting beneficial properties in member retention and spending per member. Its HomeCount Heroes program continues to draw new prospects. The firm’s rising presence in out of doors recreation and wildlife provides, together with the Field & Stream model launch, is additional increasing its relevance with core prospects.

Strategic initiatives, together with digital development, same-day supply, Final Mile growth, and the scaling of its direct gross sales program, are gaining traction and are anticipated to start self-funding within the coming yr. With wholesome buyer demand, disciplined price controls, and strengthening strategic capabilities, Tractor Supply seems well-positioned to handle near-term price pressures whereas sustaining its long-term development trajectory. The firm’s worth proposition in rural markets continues to achieve momentum with its companions. For fiscal 2026, Tractor Supply plans to increase self-service instruments and promoting choices. With this growth and momentum, Tractor Supply is well-positioned to maintain profitability and obtain regular development regardless of ongoing price pressures.

The Zacks Rundown for TSCO

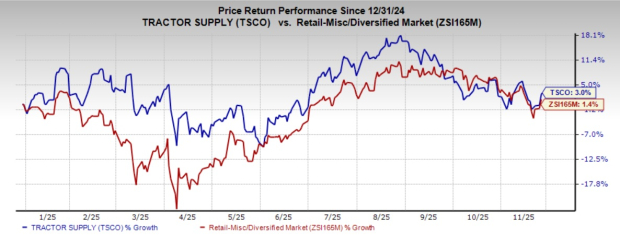

TSCO’s shares have gained 3% yr so far in contrast with the industry’s rise of 1.4%. TSCO carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

From a valuation standpoint, TSCO trades at a ahead price-to-earnings ratio of 23.7X, greater than the business’s common of 17.9X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for TSCO’s 2025 and 2026 earnings implies a year-over-year rise of three.4% and 10.5%, respectively. TSCO delivered a trailing four-quarter damaging earnings shock of 1.8%, on common.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked shares have been mentioned under:

Ulta Beauty, Inc. ULTA operates as a specialty magnificence retailer within the United States, Mexico, and Kuwait. At current, Ulta Beauty holds a Zacks Rank of two (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for ULTA’s present fiscal-year gross sales implies development of 6.8% and earnings point out a decline of three.8% from the year-ago figures. ULTA delivered a trailing four-quarter earnings shock of 16.3%, on common.

Boot Barn Holdings, Inc. BOOT operates specialty retail shops within the United States and internationally. At current, Boot Barn holds a Zacks Rank of two.

The Zacks Consensus Estimate for Boot Barn’s present fiscal-year gross sales and earnings signifies development of 16.2% and 20.5%, respectively, from the year-ago figures. BOOT delivered a trailing four-quarter earnings shock of 5.4%, on common.

Five Below, Inc. FIVE operates as a specialty worth retailer within the United States. At current, Five Below holds a Zacks Rank of two.

The Zacks Consensus Estimate for FIVE’s present fiscal-year gross sales and earnings signifies development of 16.2% and 1.2%, respectively, from the year-ago figures. FIVE delivered a trailing four-quarter earnings shock of fifty.5%, on common.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the funding panorama, and its convergence with quantum computing might result in probably the most vital wealth-building alternatives of our time.

Today, you may have an opportunity to place your portfolio on the forefront of this technological revolution. In our pressing particular report, Beyond AI: The Quantum Leap in Computing Power, you will uncover the little-known shares we consider will win the quantum computing race and ship large beneficial properties to early traders.

Tractor Supply Company (TSCO) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

This web page was created programmatically, to learn the article in its unique location you’ll be able to go to the hyperlink bellow:

https://www.nasdaq.com/articles/can-tractor-supplys-rural-lifestyle-demand-offset-cost-pressures

and if you wish to take away this text from our website please contact us