This web page was created programmatically, to learn the article in its authentic location you may go to the hyperlink bellow:

https://www.bbc.com/news/articles/cg4nzp6ezg7o

and if you wish to take away this text from our website please contact us

Sima Kotecha,Senior UK correspondentand

Guy Lambert

BBC

BBC“They don’t keep money, they spend it here and now.”

Det Ch Insp Paul Curtis is displaying us round an proof room piled excessive with designer sneakers and purses. Thousands of things are neatly stacked in plastic containers on picket cabinets.

The objects right here have been seized from monetary fraudsters, a few of whom ship rip-off texts – often called smishing – to victims.

“They like to live a lavish lifestyle,” says Curtis. “We have got somewhere between 8,500 and 10,000 items of evidence in this one room,” he says, one thing that’s “the result of house searches and raids” carried out by officers.

The scent of recent leather-based items pervades the air. Brightly colored Gucci stilettos catch the attention from a distance; it is a treasure trove of top-label package value tens of hundreds of kilos.

These purchases are a sign of how a lot money they’re making from their crimes and what they’re spending it on.

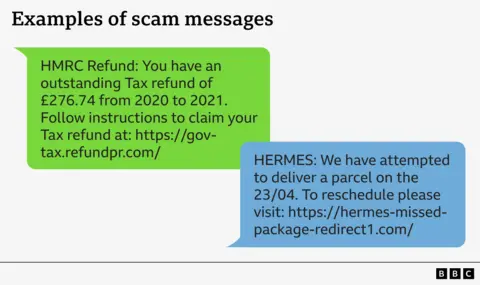

The time period “smishing” is a mix of “SMS”, or “short message service” – the know-how behind textual content messages – and “phishing”.

Fraudsters ship faux textual content messages – apparently from a financial institution or different trusted firm – to trick individuals into disclosing private data resembling passwords and Pin numbers. The intention is to defraud them out of their cash.

Curtis is a part of the Dedicated Card and Payment Crime Unit – a workforce made up of officers from the City of London Police and the Metropolitan Police service.

Although they’re London police forces, the unit has a nationwide remit, and is sponsored by the banking business. It focuses on combating monetary fraud.

“In a recent smishing case of ours, the defendant was sentenced on the basis of sending 15,000 messages in a five day period. That equated to making a hundred thousand pounds a month,” he says.

The senior officer was speaking about Ruichen Xiong, a pupil from China who was convicted of the crime after driving round London in March of this yr, sending messages to tens of hundreds of potential victims.

Xiong was sentenced to 58 weeks in jail at Inner London Crown Court in June after pleading responsible to fraud by illustration.

According to Ofcom, half of UK cell customers stated they obtained a suspicious message between November 2024 and February 2025 through textual content or iMessage.

‘I felt like a large idiot, like I’d been violated’

Gideon Rabinowitz, 64, lives in Newbury, Berkshire, and is a current sufferer of smishing.

Just two months in the past, the previous IT supervisor stated he was cheated out of greater than a thousand kilos after receiving a fraudulent textual content message.

“I felt like a massive fool, like I’d been violated,” he says.

“It really shook me. For a number of days after it really left me quite shaken. I felt very vulnerable and I don’t know who to trust now.”

Mr Rabinowitz was led to imagine he was being contacted by his financial institution who had been reporting a suspicious cost on his account.

In actuality, he was being messaged by a scammer.

“It started with a text out of the blue asking if I recognised a transaction – yes or no. Two and half hours later I was out of pocket by £1400.”

He provides: “In part it was about the money and it was also this feeling of being defrauded, of being looked up, because these people knew who I was. They knew where I live”.

Scam textual content messages typically faux to be from massive firms resembling utility firms, banks or supermarkets. They often embrace a hyperlink. Once the particular person clicks on it, they are often despatched to a fraudulent web site and requested for private and monetary data. The data can then be used to persuade them to switch cash from their account.

Smishing is primarily completed by way of two gadgets; a Sim farm which holds a number of Sim playing cards, permitting criminals to bombard individuals with hundreds of rip-off texts.

The second is what’s known as an SMS Blaster. It methods mobiles close by into connecting with it, after which sends massive numbers of fraudulent texts in a matter of seconds.

The authorities says “smishing scams have a devastating impact on their victims”.

“Our Telecoms Charter sets out clear action to secure SMS and reduce fraud across the telecoms sector”.

“We are also banning Sim farms. Banning these devices used to send thousands of scam texts will close down a key tool for criminals and safeguard consumers,” it says.

The ban is anticipated to return into impact late subsequent yr. It will make the possession or provide of Sim farms, with out a specified cause, unlawful.

‘Easy to do, laborious to hint’

One cyber professional stated smishing was a troublesome crime to resolve and that there must be extra training round fraudulent textual content messages.

“Smishing in and of itself is very hard to police because a lot of it comes from abroad and, even when it’s done from within the UK it’s very easy to do and hard to trace, ” says Ciaran Martin, the previous Chief Executive of the National Cyber Security Centre.

“So while the police can sometimes take down big operations, we shouldn’t look to the police as the strategic answer for this.

“The strategic reply is for individuals to grasp that severe companies do not ask you for cash by textual content, and for companies to search out higher methods of interacting with prospects and verifying that interplay”.

The advice from police is simple: do not click on the links in any unsolicited messages you receive.

If you believe you’re a victim of fraud, report to Action Fraud, report to your bank, and forward the message to 7726 so the mobile networks can investigate further.

For extra data go to bbc.co.uk/scamsafe the place you could find a number of sources

If you will have been scammed or defrauded, particulars of assist and assist can be found at bbc.co.uk/actionline

This web page was created programmatically, to learn the article in its authentic location you may go to the hyperlink bellow:

https://www.bbc.com/news/articles/cg4nzp6ezg7o

and if you wish to take away this text from our website please contact us