This web page was created programmatically, to learn the article in its authentic location you possibly can go to the hyperlink bellow:

https://stockstory.org/us/stocks/nyse/byd/news/earnings/boyd-gamings-nysebyd-q4-cy2025-sales-beat-estimates

and if you wish to take away this text from our web site please contact us

Gaming and hospitality firm Boyd Gaming (NYSE:BYD) reported This fall CY2025 outcomes exceeding the market’s income expectations, with gross sales up 2% yr on yr to $1.06 billion. Its non-GAAP revenue of $2.21 per share was 14.2% above analysts’ consensus estimates.

Is now the time to purchase Boyd Gaming? Find out by accessing our full analysis report, it’s free.

Boyd Gaming (BYD) This fall CY2025 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.02 billion (2% year-on-year development, 4% beat)

- Adjusted EPS: $2.21 vs analyst estimates of $1.94 (14.2% beat)

- Adjusted EBITDA: $308 million vs analyst estimates of $307.9 million (29% margin, in line)

- Operating Margin: 15.7%, down from 25.1% in the identical quarter final yr

- Market Capitalization: $6.62 billion

Company Overview

Run by the Boyd household, Boyd Gaming (NYSE:BYD) is a diversified operator of gaming leisure properties throughout the United States, providing on line casino video games, lodge lodging, and eating.

Revenue Growth

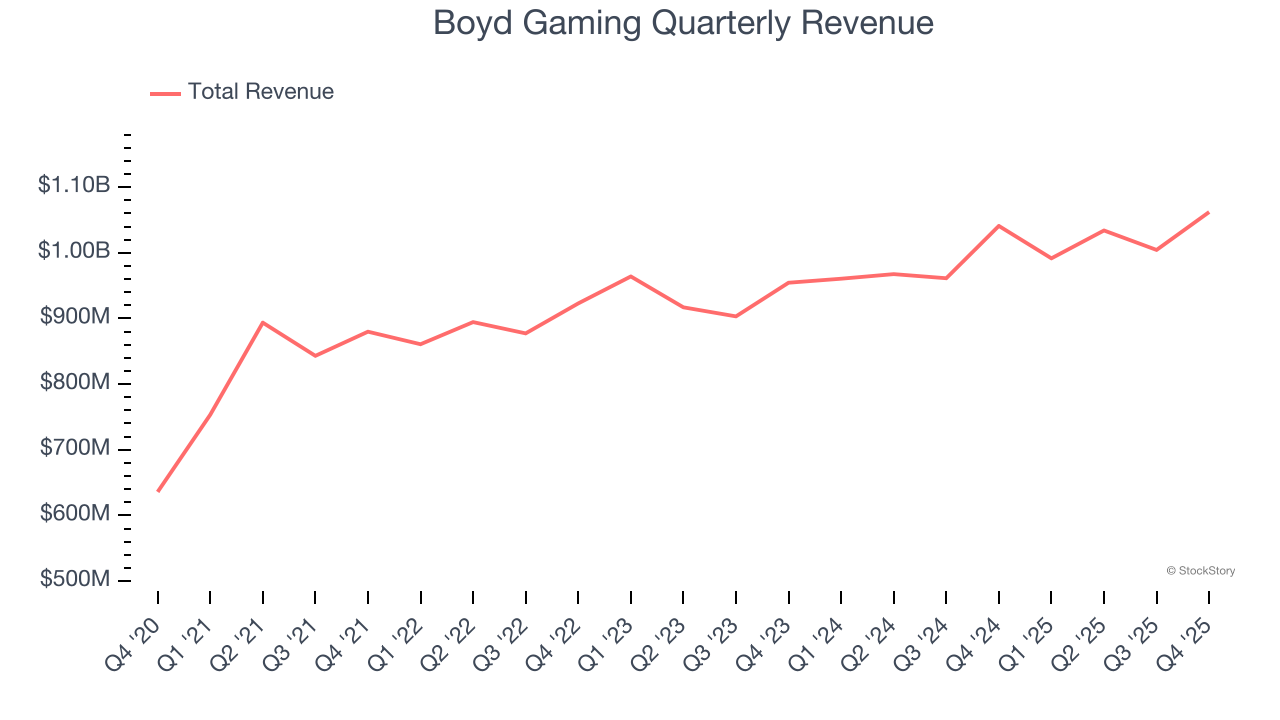

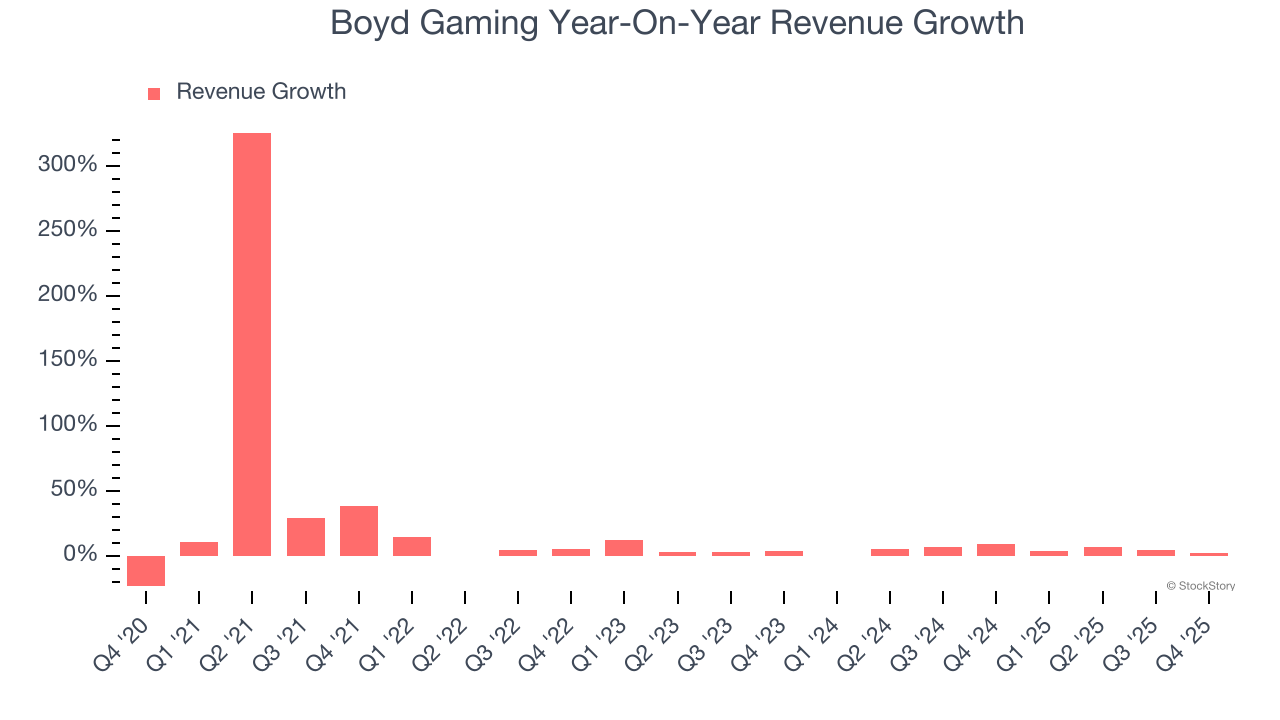

An organization’s long-term gross sales efficiency is one sign of its general high quality. Any enterprise can have short-term success, however a top-tier one grows for years. Over the final 5 years, Boyd Gaming grew its gross sales at a 13.4% compounded annual development price. Although this development is appropriate on an absolute foundation, it fell wanting our requirements for the buyer discretionary sector, which enjoys quite a lot of secular tailwinds.

Long-term development is an important, however inside client discretionary, product cycles are quick and income could be hit-driven on account of quickly altering traits and client preferences. Boyd Gaming’s current efficiency exhibits its demand has slowed as its annualized income development of 4.6% during the last two years was beneath its five-year pattern. Note that COVID damage Boyd Gaming’s enterprise in 2020 and a part of 2021, and it bounced again in an enormous approach thereafter.

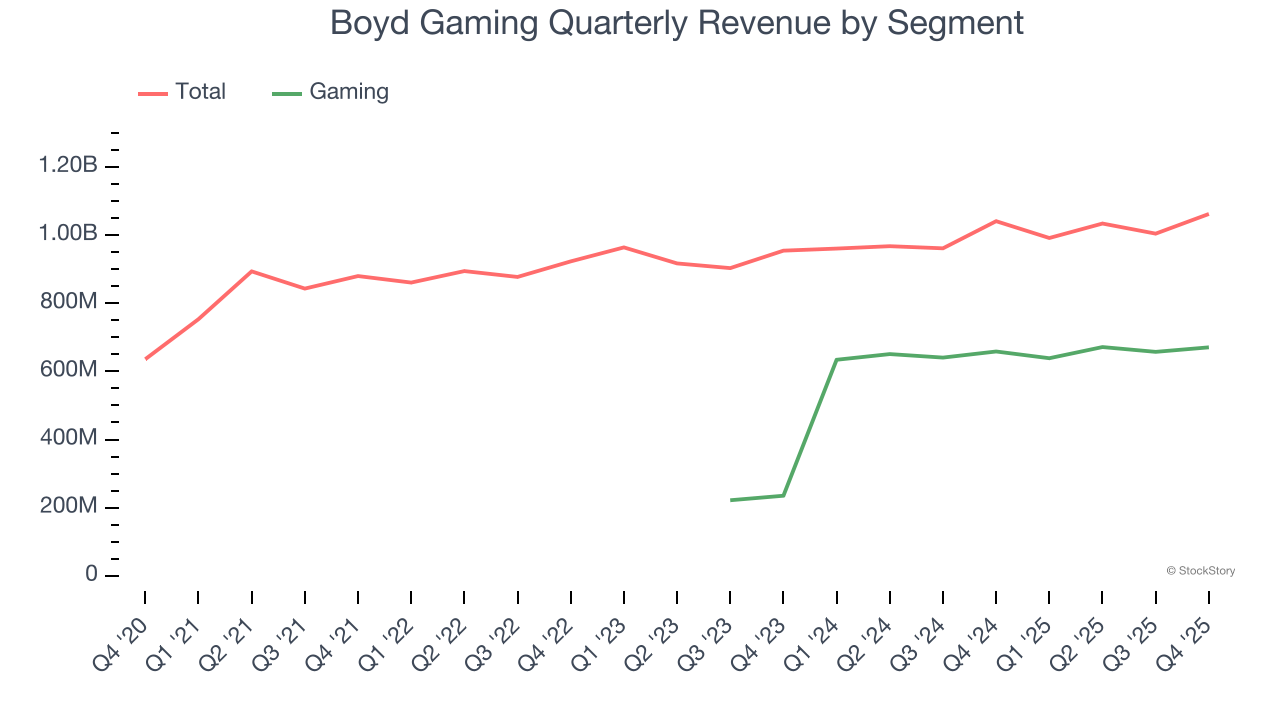

We can dig additional into the corporate’s income dynamics by analyzing its most essential section, Gaming. Over the final two years, Boyd Gaming’s Gaming income (on line casino video games) averaged 62.9% year-on-year development. This section has outperformed its complete gross sales throughout the identical interval, lifting the corporate’s efficiency.

This quarter, Boyd Gaming reported modest year-on-year income development of two% however beat Wall Street’s estimates by 4%.

Looking forward, sell-side analysts anticipate income to stay flat over the subsequent 12 months, a deceleration versus the final two years. This projection would not excite us and suggests its services and products will see some demand headwinds.

The 1999 e book Gorilla Game predicted Microsoft and Apple would dominate tech earlier than it occurred. Its thesis? Identify the platform winners early. Today, enterprise software program firms embedding generative AI have gotten the brand new gorillas. a worthwhile, fast-growing enterprise software program inventory that’s already driving the automation wave and trying to catch the generative AI subsequent.

Operating Margin

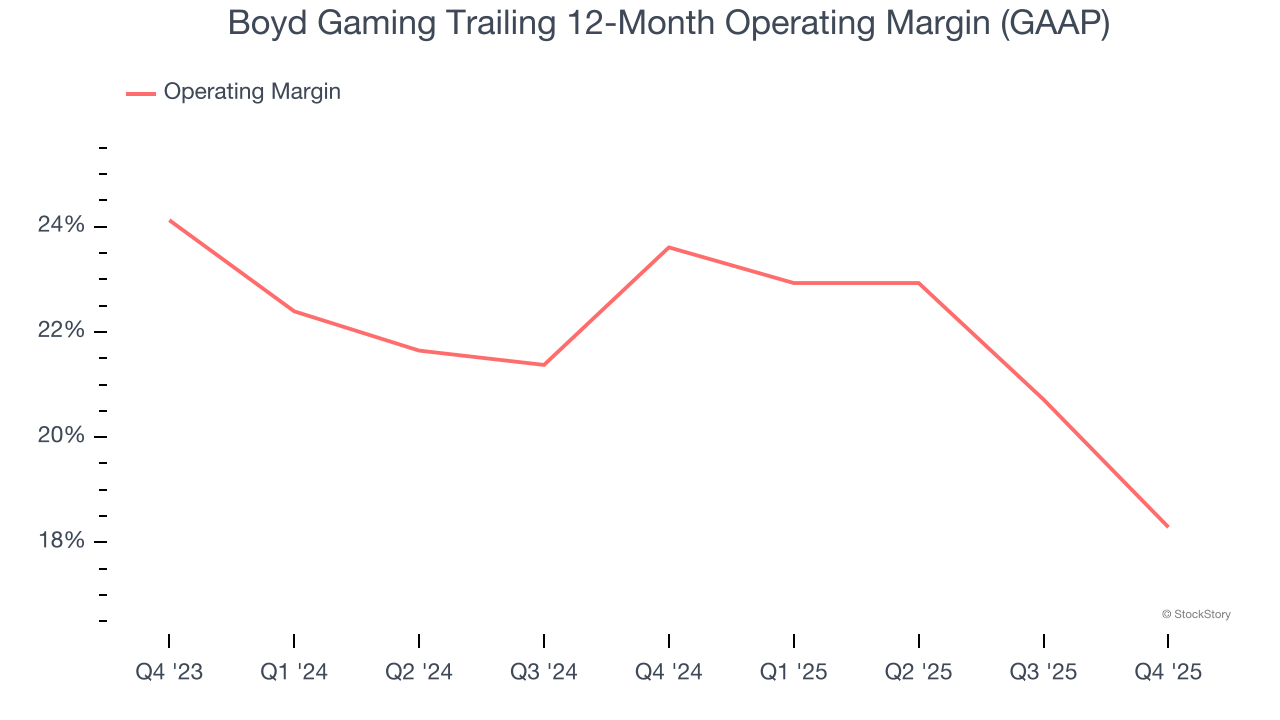

Boyd Gaming’s working margin has been trending down during the last 12 months and averaged 20.9% during the last two years. The firm’s profitability was mediocre for a client discretionary enterprise and exhibits it couldn’t go its larger working bills onto its prospects.

In This fall, Boyd Gaming generated an working margin revenue margin of 15.7%, down 9.4 share factors yr on yr. This contraction exhibits it was much less environment friendly as a result of its bills grew sooner than its income.

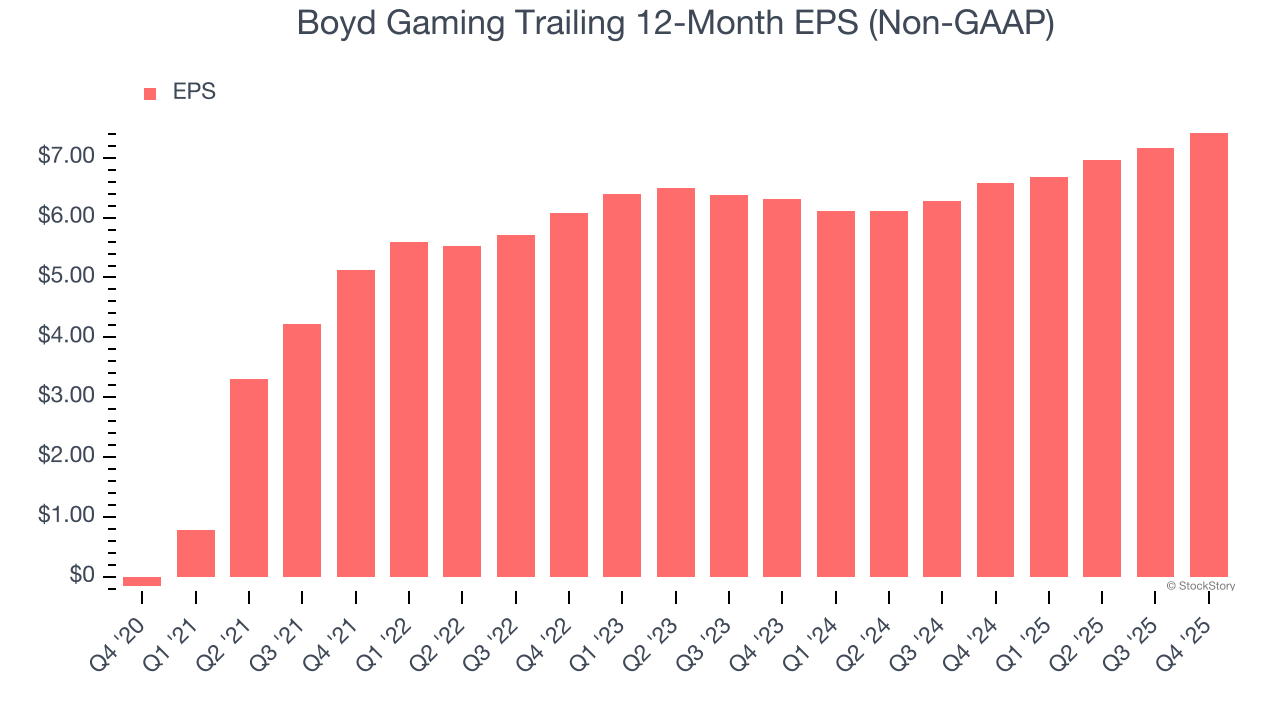

Earnings Per Share

Revenue traits clarify an organization’s historic development, however the long-term change in earnings per share (EPS) factors to the profitability of that development – for instance, an organization might inflate its gross sales by way of extreme spending on promoting and promotions.

Boyd Gaming’s full-year EPS flipped from damaging to constructive during the last 5 years. This is encouraging and exhibits it’s at a vital second in its life.

In This fall, Boyd Gaming reported adjusted EPS of $2.21, up from $1.96 in the identical quarter final yr. This print simply cleared analysts’ estimates, and shareholders needs to be content material with the outcomes. Over the subsequent 12 months, Wall Street expects Boyd Gaming’s full-year EPS of $7.42 to develop 5.9%.

Key Takeaways from Boyd Gaming’s This fall Results

We loved seeing Boyd Gaming beat analysts’ income expectations this quarter. We had been additionally glad its EPS outperformed Wall Street’s estimates. Overall, we expect this was a strong quarter with some key areas of upside. The market gave the impression to be hoping for extra, and the inventory traded down 1% to $84.72 instantly after reporting.

Big image, is Boyd Gaming a purchase right here and now? When making that call, it’s essential to contemplate its valuation, enterprise qualities, in addition to what has occurred within the newest quarter. We cowl that in our actionable full analysis report which you’ll learn right here (it’s free).

This web page was created programmatically, to learn the article in its authentic location you possibly can go to the hyperlink bellow:

https://stockstory.org/us/stocks/nyse/byd/news/earnings/boyd-gamings-nysebyd-q4-cy2025-sales-beat-estimates

and if you wish to take away this text from our web site please contact us