This web page was created programmatically, to learn the article in its authentic location you’ll be able to go to the hyperlink bellow:

https://simplywall.st/stocks/in/tech/nse-cellecor/cellecor-gadgets-shares/news/cellecor-gadgets-limited-nsecellecor-might-not-be-as-mispric

and if you wish to take away this text from our website please contact us

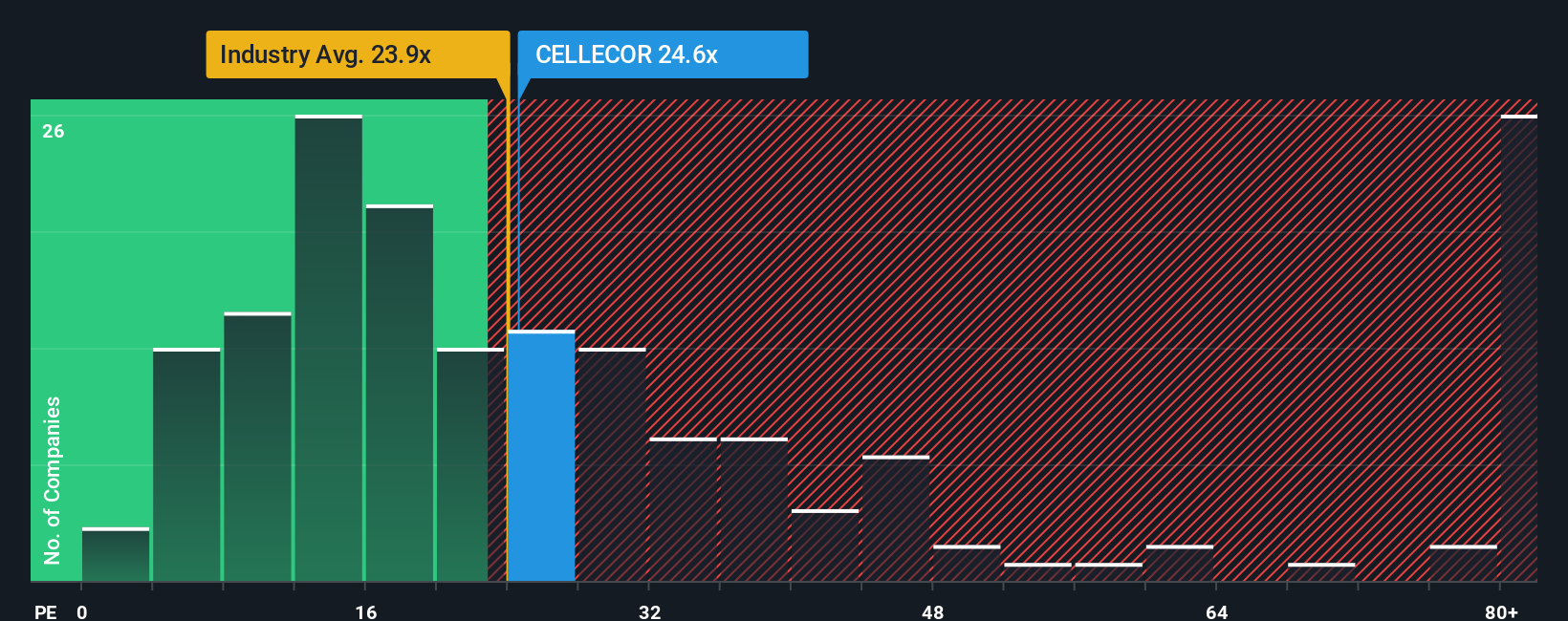

When near half the businesses in India have price-to-earnings ratios (or “P/E’s”) above 28x, it’s possible you’ll think about Cellecor Gadgets Limited (NSE:CELLECOR) as a gorgeous funding with its 24.6x P/E ratio. Although, it is not sensible to only take the P/E at face worth as there could also be an reason why it is restricted.

Trump has pledged to “unleash” American oil and gasoline and these 15 US shares have developments which can be poised to learn.

With earnings development that is exceedingly robust of late, Cellecor Gadgets has been doing very nicely. One risk is that the P/E is low as a result of buyers suppose this robust earnings development would possibly really underperform the broader market within the close to future. If that does not eventuate, then present shareholders have motive to be fairly optimistic in regards to the future path of the share worth.

Check out our newest evaluation for Cellecor Gadgets

Want the complete image on earnings, income and money circulation for the corporate? Then our free report on Cellecor Gadgets will enable you shine a light-weight on its historic efficiency.

How Is Cellecor Gadgets’ Growth Trending?

There’s an inherent assumption that an organization ought to underperform the marketplace for P/E ratios like Cellecor Gadgets’ to be thought-about affordable.

If we overview the final 12 months of earnings development, the corporate posted a terrific enhance of 63%. Pleasingly, EPS has additionally lifted 666% in combination from three years in the past, due to the final 12 months of development. Accordingly, shareholders would have most likely welcomed these medium-term charges of earnings development.

This is in distinction to the remainder of the market, which is anticipated to develop by 25% over the following 12 months, materially decrease than the corporate’s current medium-term annualised development charges.

With this info, we discover it odd that Cellecor Gadgets is buying and selling at a P/E decrease than the market. It seems to be like most buyers usually are not satisfied the corporate can preserve its current development charges.

The Bottom Line On Cellecor Gadgets’ P/E

Typically, we would warning towards studying an excessive amount of into price-to-earnings ratios when deciding on funding choices, although it will possibly reveal a lot about what different market contributors take into consideration the corporate.

Our examination of Cellecor Gadgets revealed its three-year earnings tendencies aren’t contributing to its P/E wherever close to as a lot as we’d have predicted, given they appear higher than present market expectations. When we see robust earnings with faster-than-market development, we assume potential dangers are what is perhaps putting important stress on the P/E ratio. It seems many are certainly anticipating earnings instability, as a result of the persistence of those current medium-term circumstances would usually present a lift to the share worth.

Don’t neglect that there could also be different dangers. For occasion, we have recognized 3 warning indicators for Cellecor Gadgets (2 are important) you have to be conscious of.

If P/E ratios curiosity you, it’s possible you’ll want to see this free assortment of different corporations with robust earnings development and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market on daily basis to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High development Tech and AI Companies

Or construct your individual from over 50 metrics.

Explore Now for Free

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We intention to carry you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

This web page was created programmatically, to learn the article in its authentic location you’ll be able to go to the hyperlink bellow:

https://simplywall.st/stocks/in/tech/nse-cellecor/cellecor-gadgets-shares/news/cellecor-gadgets-limited-nsecellecor-might-not-be-as-mispric

and if you wish to take away this text from our website please contact us