This web page was created programmatically, to learn the article in its unique location you’ll be able to go to the hyperlink bellow:

https://gamedevreports.substack.com/p/weekly-gaming-reports-recap-september-7f2

and if you wish to take away this text from our website please contact us

Reports of the week:

-

AppMagic: Top Mobile Games by Revenue and Downloads in August 2025

-

AppMagic: Mobile Casual Games in H1’25

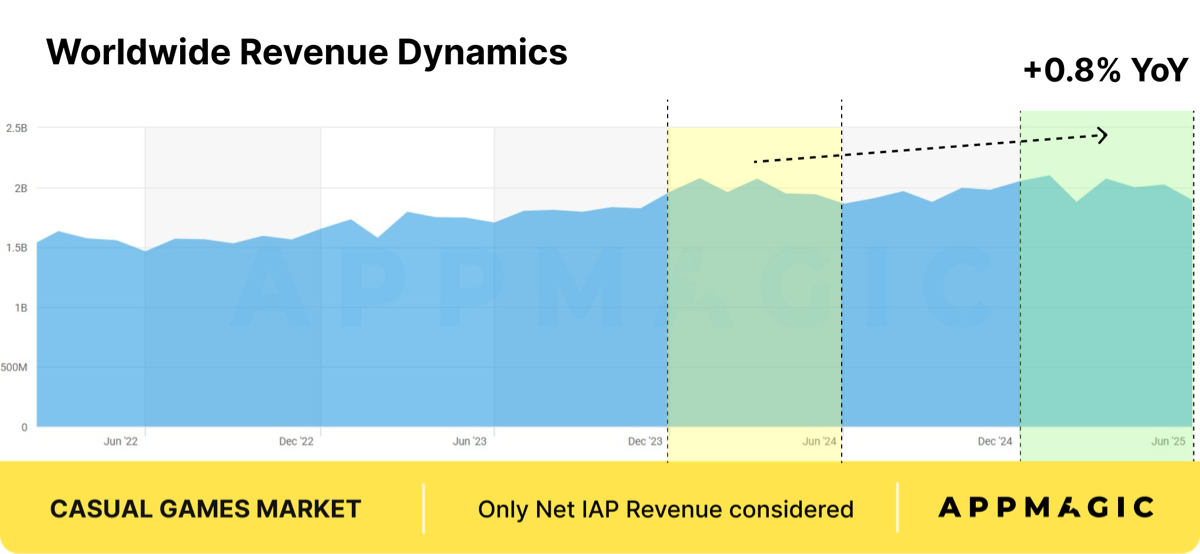

AppMagic gives income knowledge internet of retailer commissions and taxes. Revenue from Android shops in China just isn’t included.

-

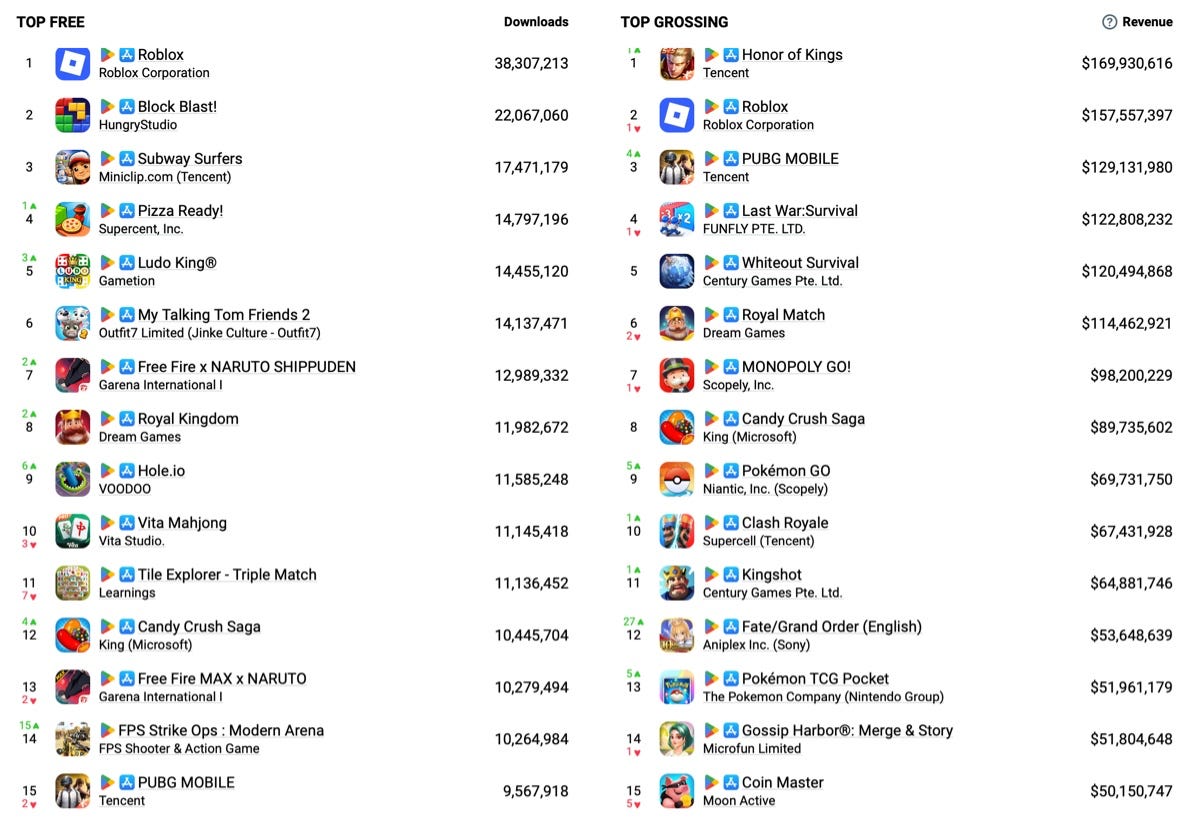

Honor of Kings returned to the #1 spot. In August, the sport made $169.9M. 97% of all income got here from China.

-

PUBG Mobile entered the highest 3 with $129.1M. This is the sport’s finest consequence since January 2023. These numbers don’t embody income from the Indian model of PUBG Mobile, which is operated by KRAFTON.

-

Pokémon GO grew additional in August, reaching $69.7M. The recreation climbed 5 spots to enter the highest 10. This is the perfect income consequence since July 2024.

-

Kingshot continues to scale, hitting $64.8M in August. Almost half of this income comes from the US, which is the sport’s greatest market. South Korea comes second, adopted by Japan.

-

Fate/Grand Order retains proving its unimaginable longevity (it launched 10 years in the past). In August, it generated $53.6M, the very best income since August 2022. The recreation’s anniversary is widely known in August, and it seems like each builders and gamers went huge for the 10-year milestone.

-

Downloads charts this time have fewer new issues than typical. The prime 15 doesn’t embody any new titles, with the standard leaders on prime: Roblox (38.3M downloads), Block Blast! (22M), Subway Surfers (17.4M).

-

Worth noting – FPS Strike Ops: Modern Arena has been persistently pulling sturdy set up numbers all through 2025 (over 10M). The developer’s account additionally options 9 different shooters in several settings.

AppMagic counts solely Net Revenue from IAP. Web outlets and Android gross sales in China will not be included.

-

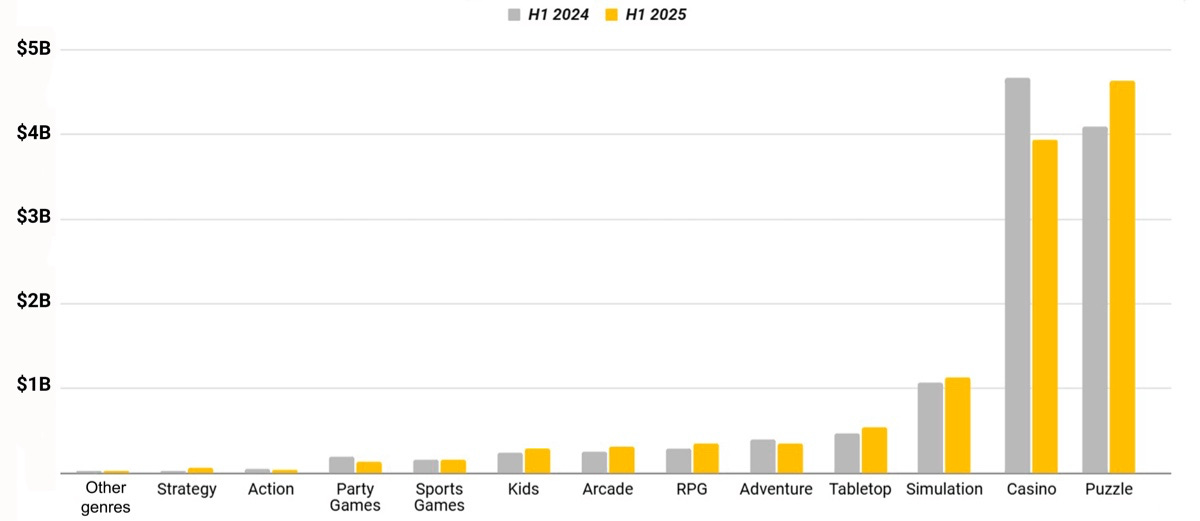

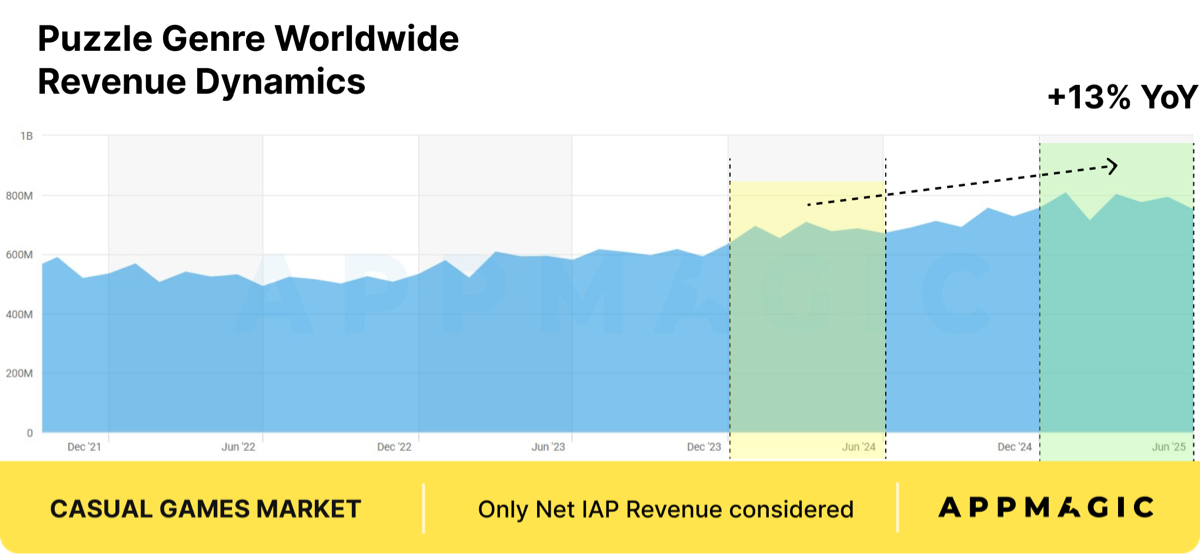

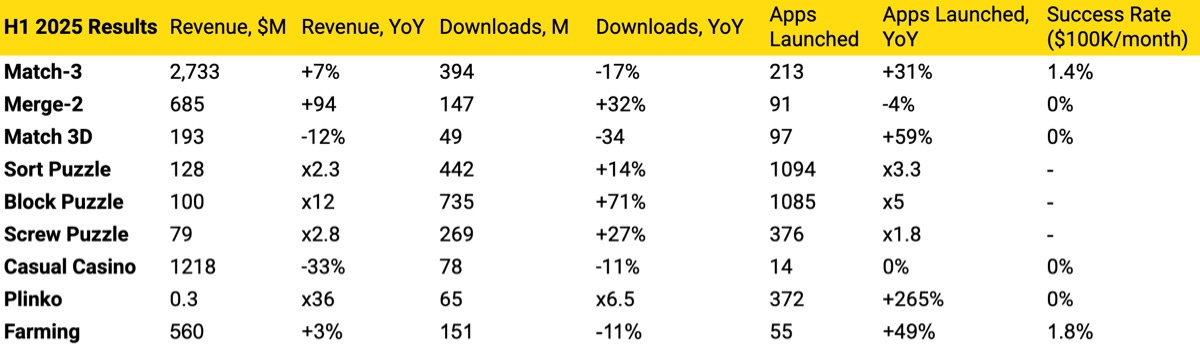

72% of whole income ($12B) comes from two genres – Puzzle and Casino. Simulation is the third by income (8%).

-

73 out of the top-100 grossing informal video games in H1’25 belong both to Casino (41) or Puzzle (32).

-

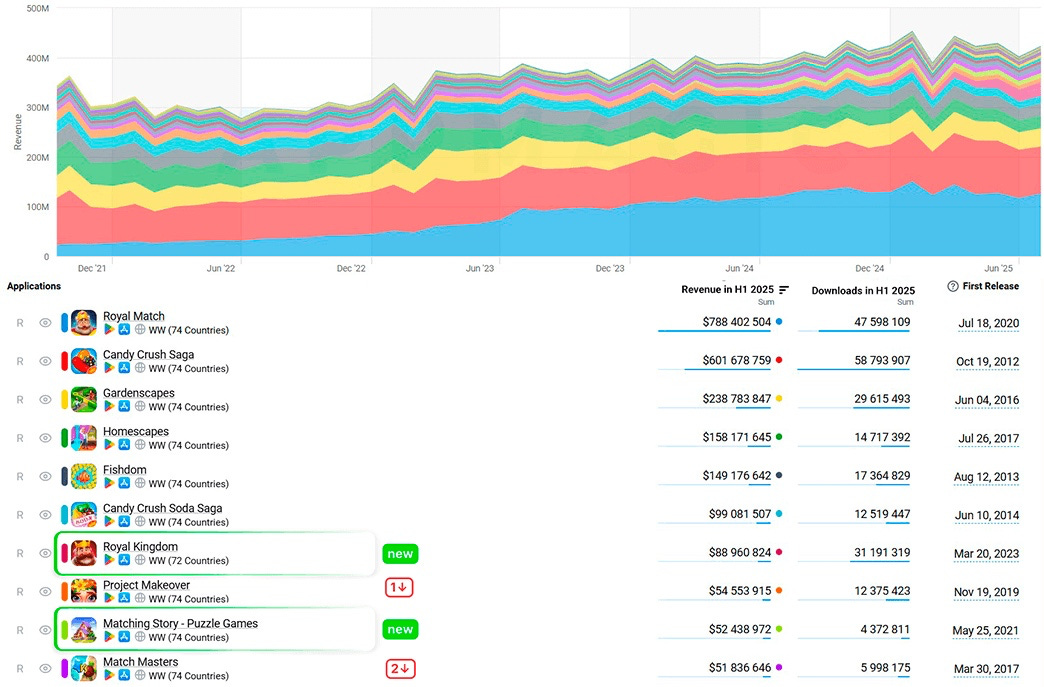

Revenue development pushed primarily by Royal Match ($788M, +15% YoY) and Candy Crush Saga ($602M, +11% YoY).

-

In truth, Candy Crush Saga set an all-time IAP income file in H1’25 (since knowledge assortment started in 2015).

-

These two titles account for greater than half of the entire Match-3 income. Without them, Match-3 income development could be simply +1% YoY.

-

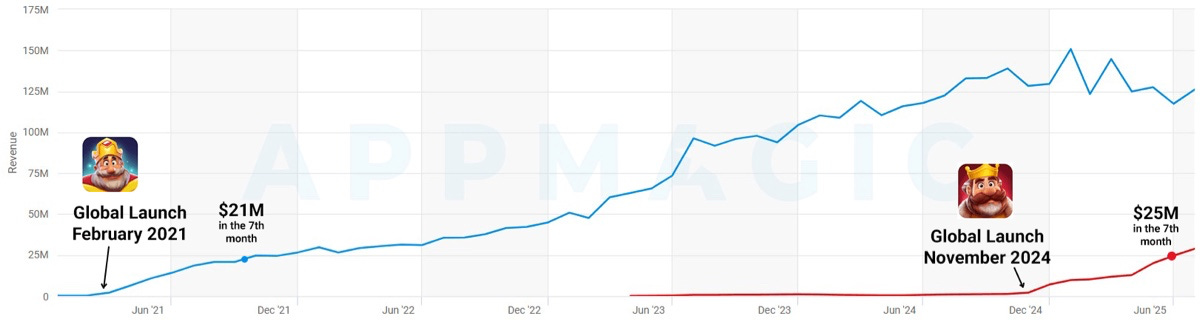

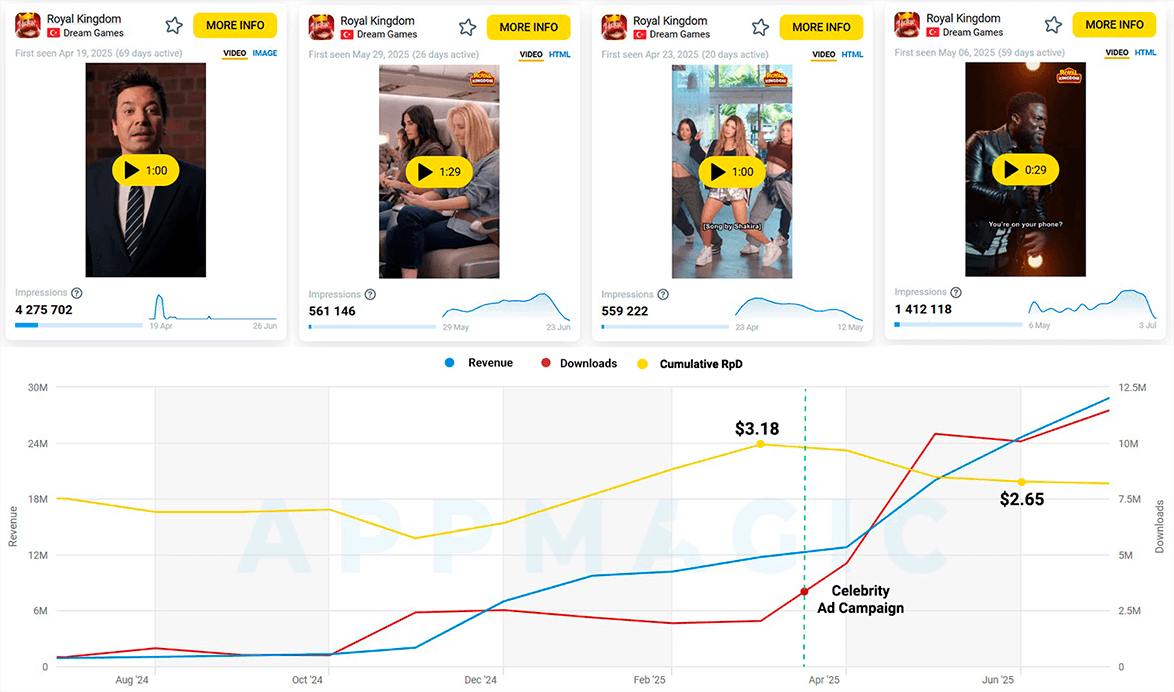

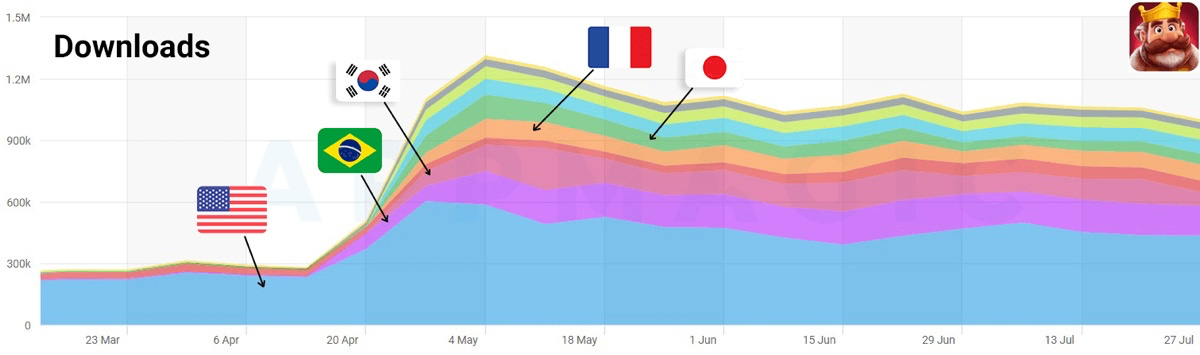

Growth is fueled by product enhancements and heavy UA spend from Dream Games. Downloads spiked to 4.6M in April (from 2M in March), peaking at 10.4M in May. In April, a high-profile superstar marketing campaign that includes LeBron James, Shakira, and others was launched.

-

However, after the UA push, RPD dropped from $3.18 in March to $2.65 in June. AppMagic explains this as greater set up quantity from low-LTV areas, whereas US RPD remained steady.

-

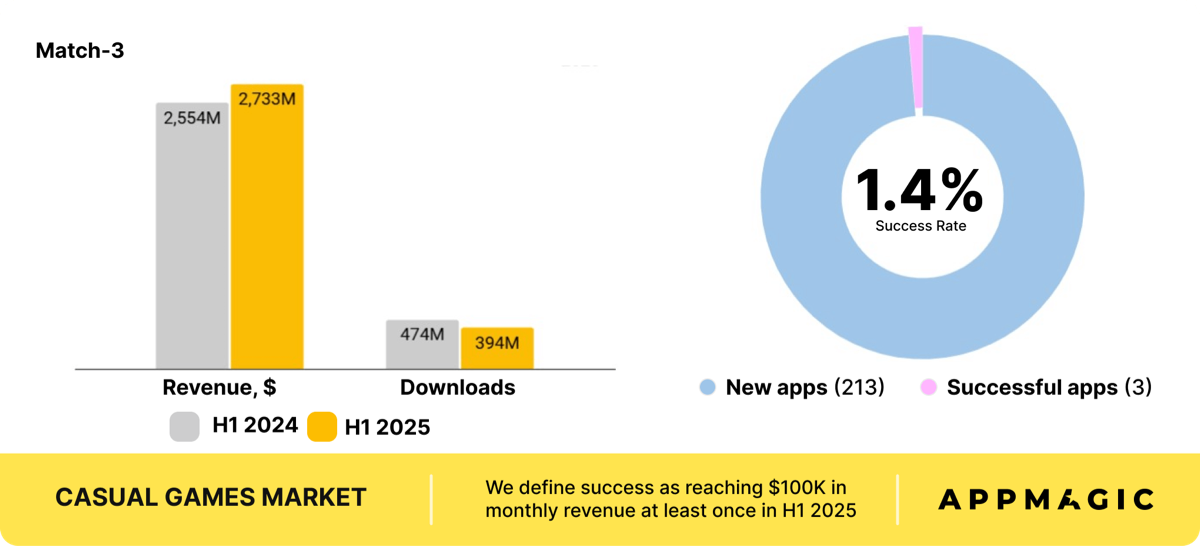

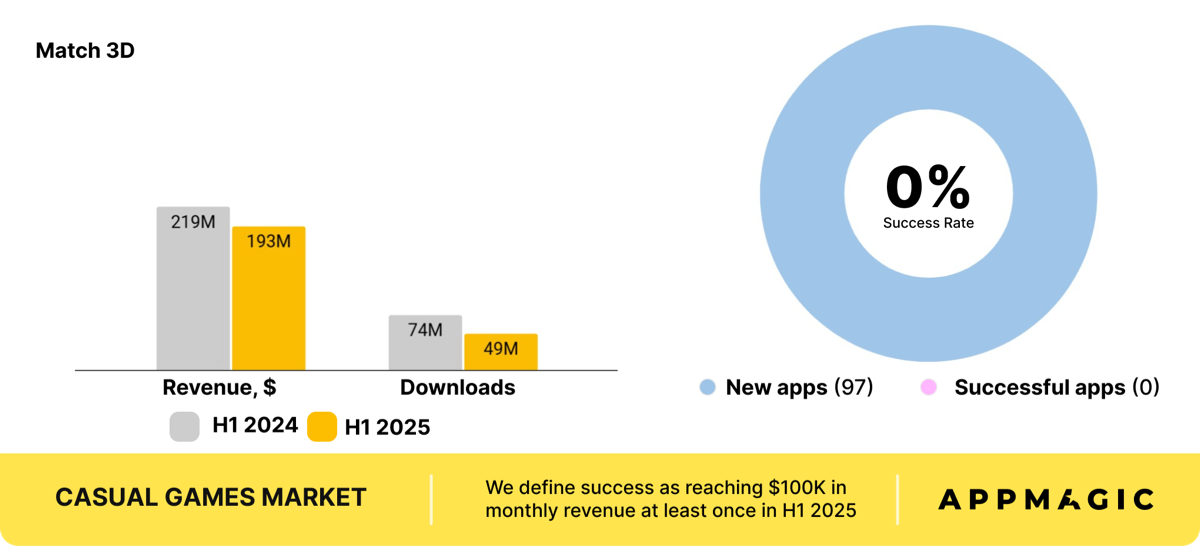

Only 3 new tasks in H1’25 crossed $100k month-to-month income out of 213 launches. Match-3 Success Rate = 1.4%.

-

Games to look at: Austin’s Odyssey (Playrix), Matching Story: Puzzle Games (Vertex Games), Match Villains (Good Job Games).

-

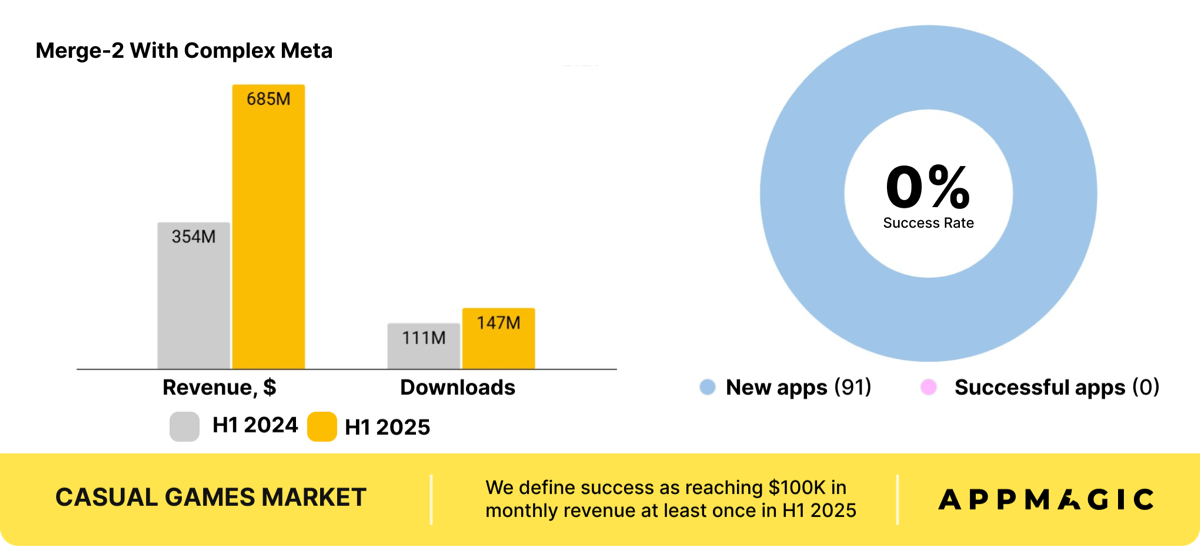

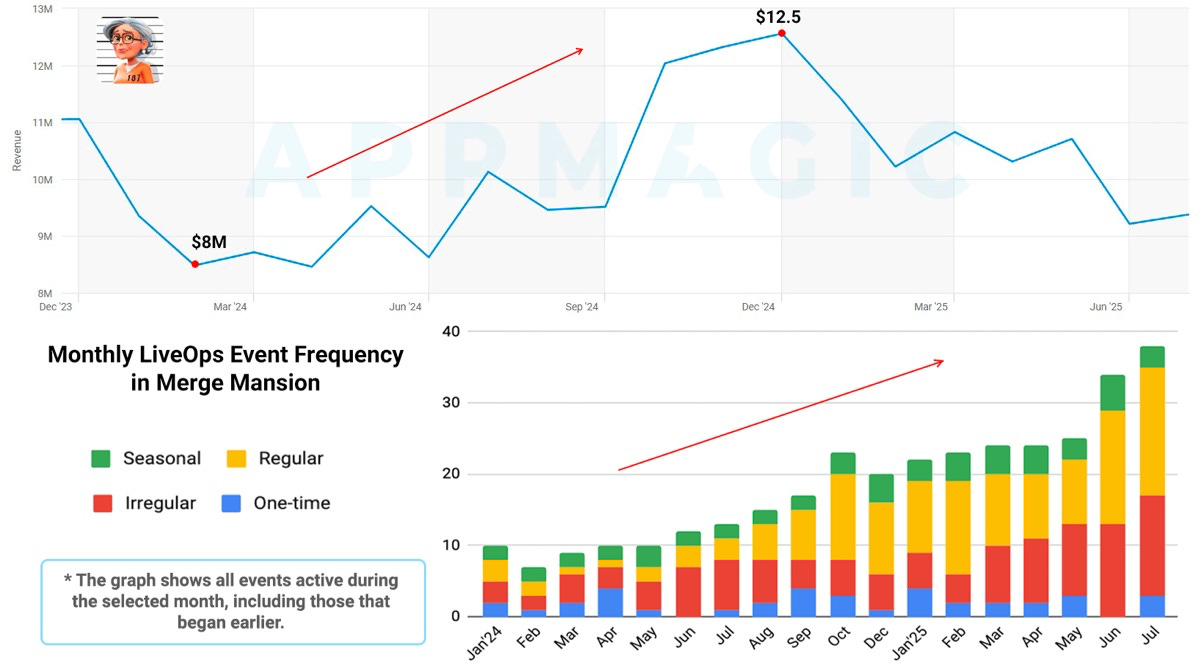

Revenue rose +94% YoY to $685M in H1’25.

-

Installs up +32% to 147M. RPD rose from $3.2 (H1’24) to $4.7 (H1’25).

-

Top ranks present no newcomers breaking by way of: not one of the 91 launches in H1’25 surpassed $100k month-to-month Net Revenue.

-

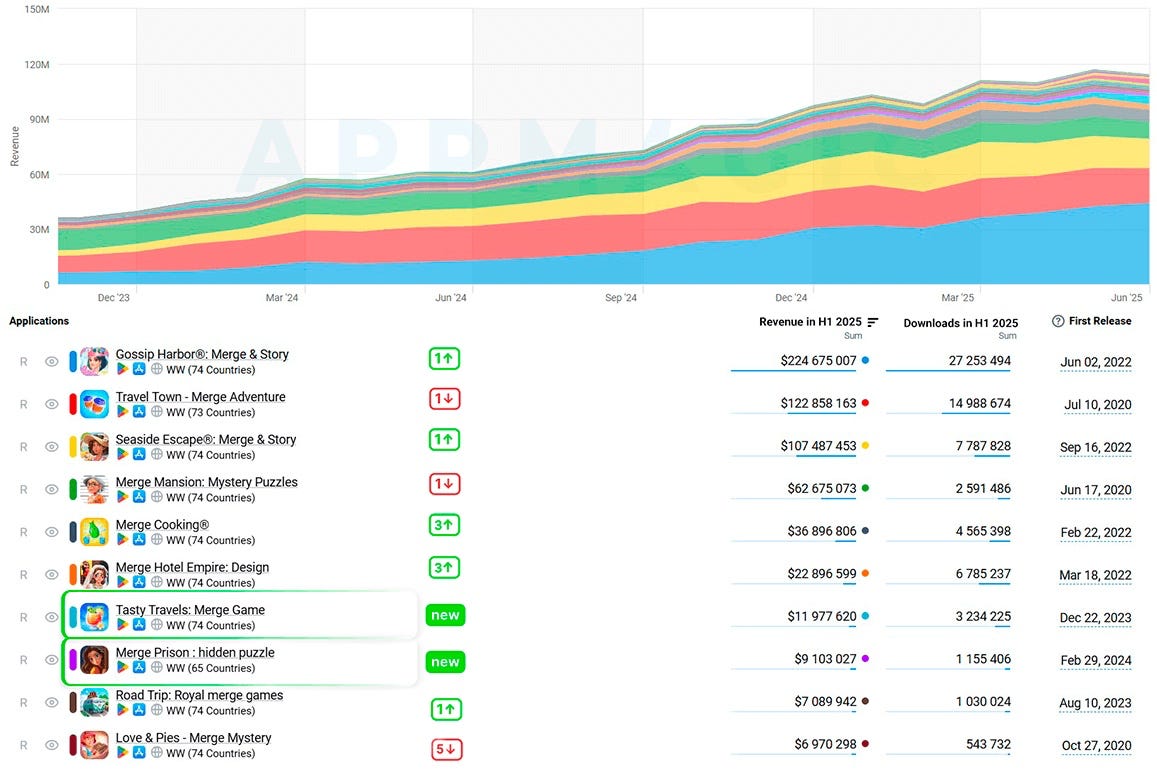

Still, some shifts on the prime: Tasty Travels: Merge Game and Merge Prison: Hidden Puzzle entered the top-10 for the primary time.

-

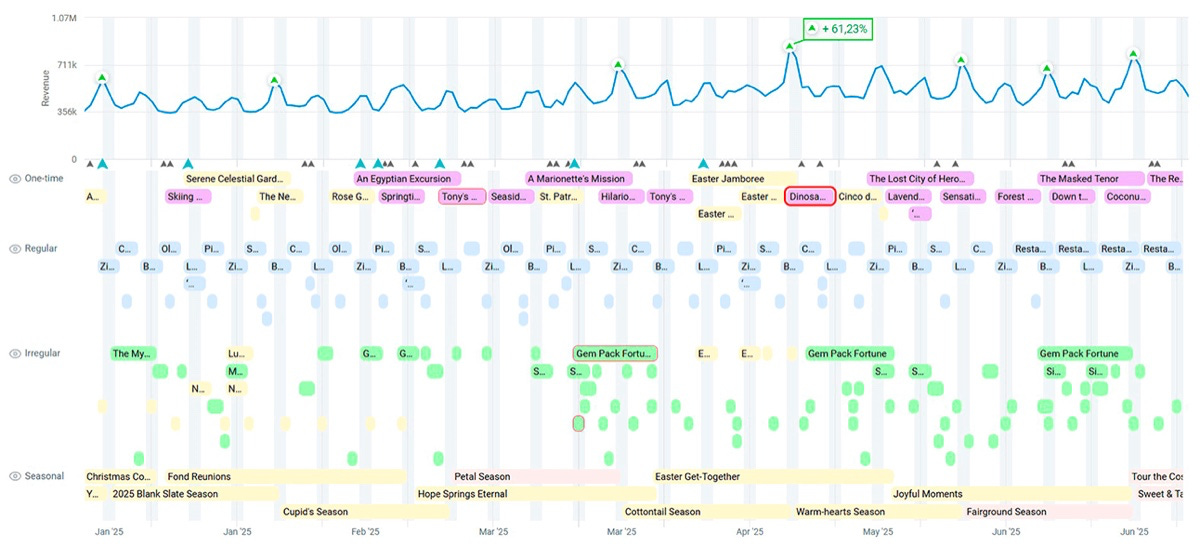

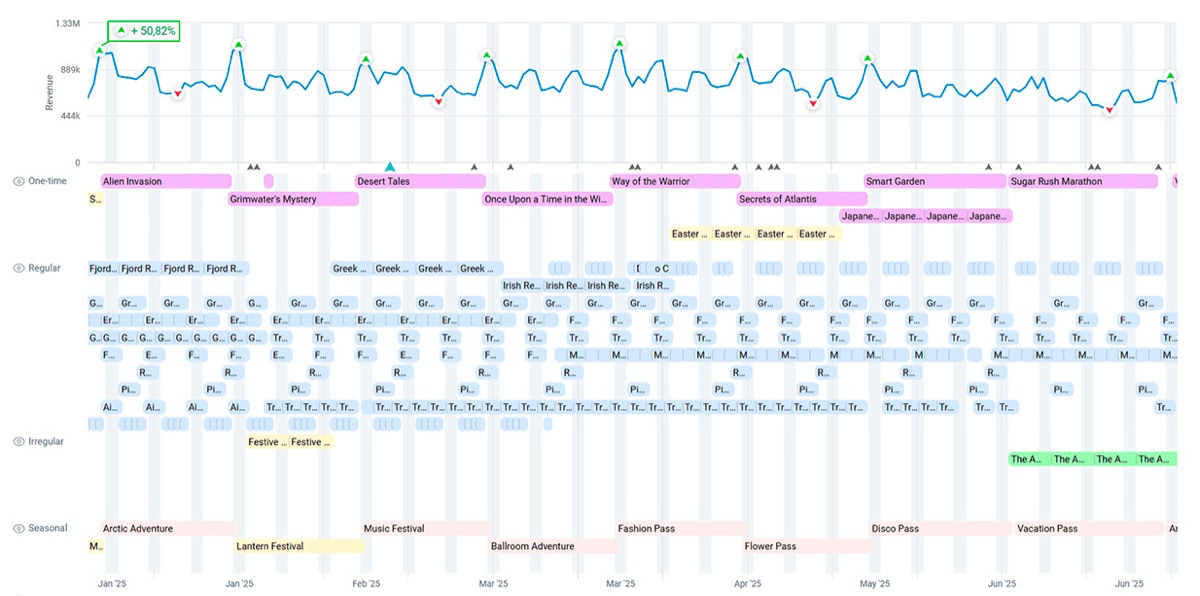

AppMagic highlights Gossip Harbor’s sturdy stay ops technique, securing #1 income spot in H1’25.

-

Merge Mansion tripled occasion frequency to spice up decline, spiking income by as much as +50%. But latest efforts are much less efficient; income reverted to early-2024 ranges. The motive, in all probability, is in the truth that gamers bought used to fixed content material drops.

-

Hyped in 2024, underperformed in 2025. Revenue fell -12% YoY to $193M, installs down -34% to 49M. None of the 97 new tasks hit $100k month-to-month.

-

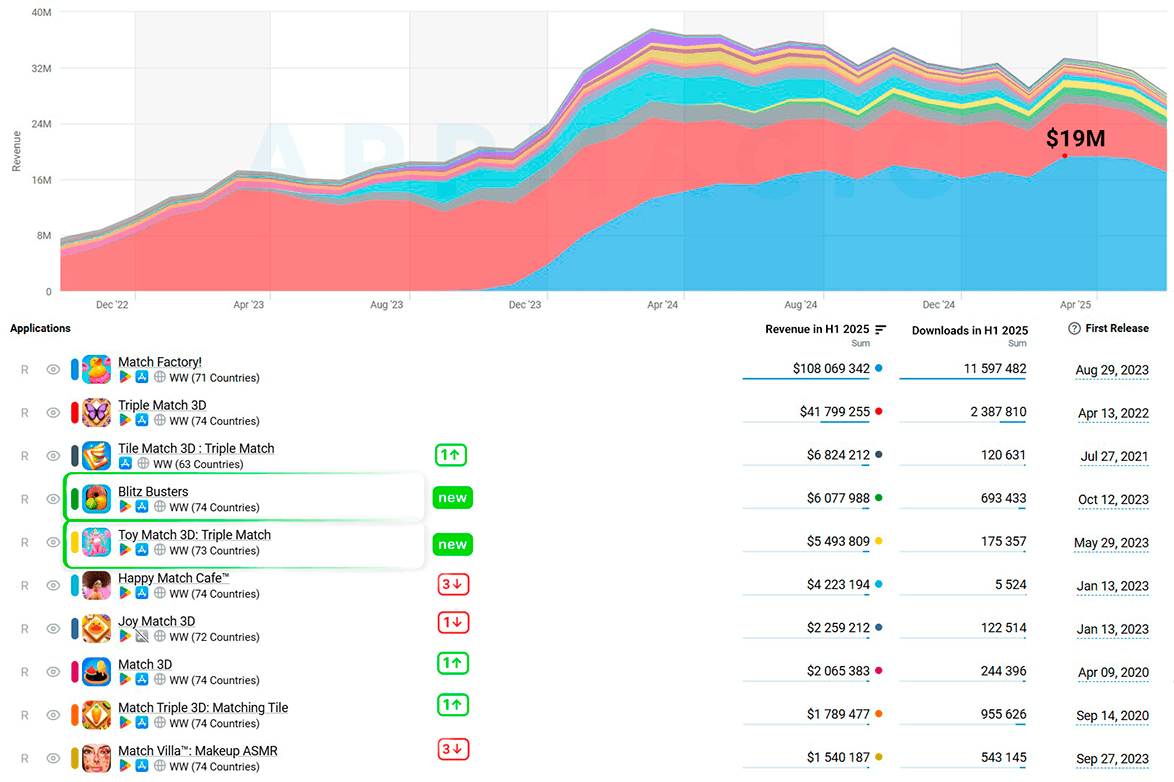

Match Factory! leads with 56% share, hitting $19M month-to-month income – a file for Match 3D.

-

Triple Match 3D: 22% share; all others mixed: 22%.

-

Games to look at: Blitz Busters (Spyke Games), Toy Match 3D: Triple Match (PLAYNEXX) – RpD in US are $13 and $27 respectively; plus fascinating newcomer Box Jam! – 3D Puzzle (Playoneer Games).

Aside from the primary matter, AppMagic ready a useful IP collaboration map on Figma with 50 collaborations that took place in 2025. Have a look!

❗️Ad monetization performs a much bigger position right here, so AppMagic notes the $100k IAP benchmark isn’t as related.

-

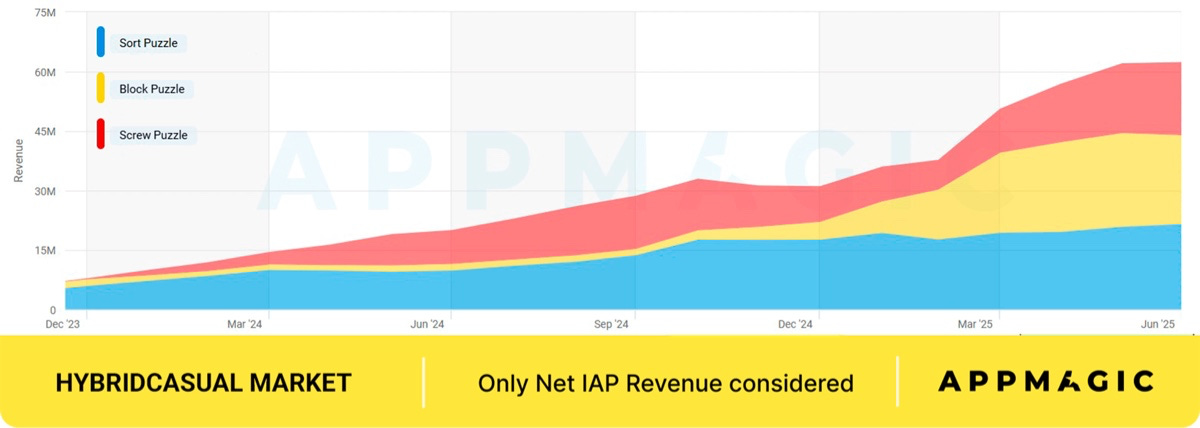

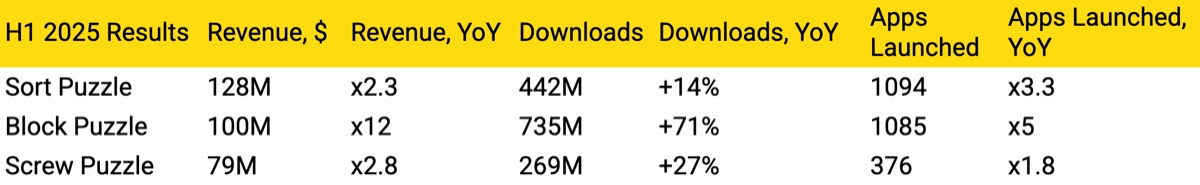

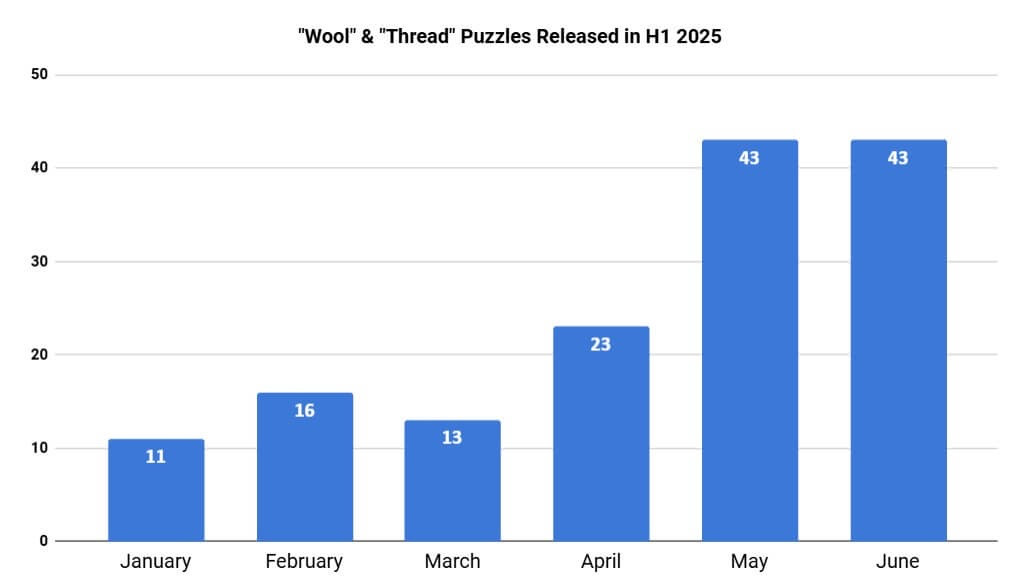

Over 2.5K tasks launched throughout these subgenres in H1’25 (376 Screw Puzzle, 2,000+ mixed Sort & Block).

-

Revenue development outpaces installs: Block Puzzle installs +71%, Screw Puzzle +27%, Sort Puzzle +14%.

-

Games to look at: Cube Busters (Spyke Games; rising), Knit Out (Rollic; top-5 income), Wool Craze – Yarn Color Sort 3D (SparkWish).

-

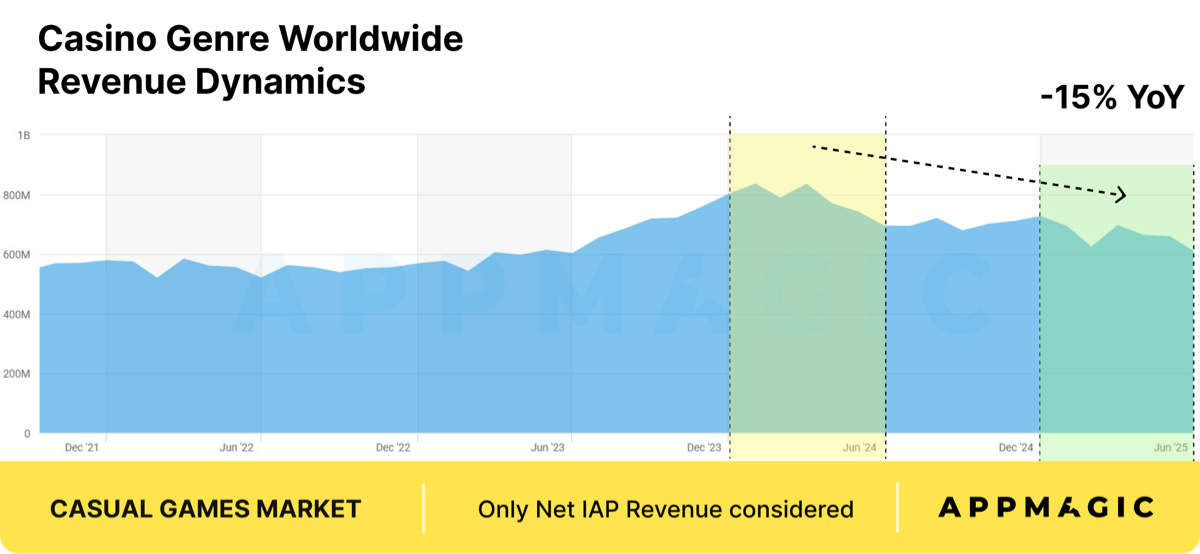

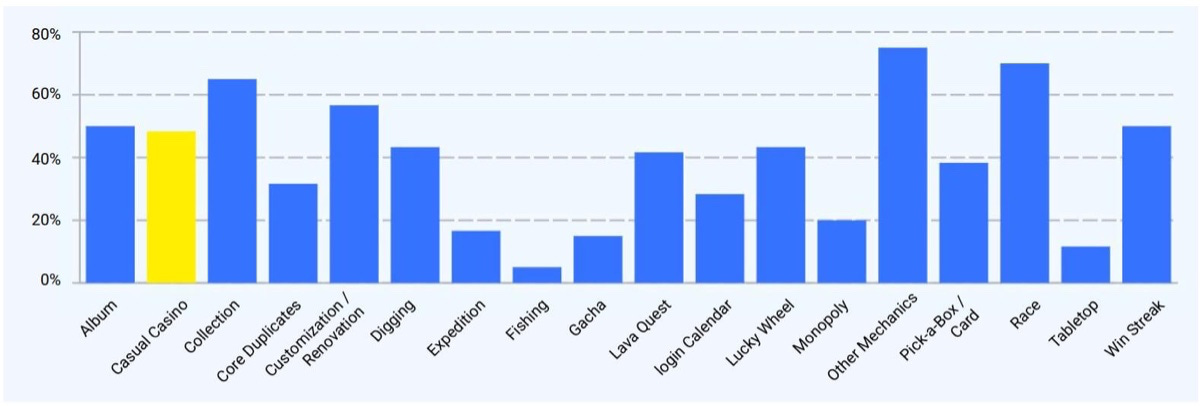

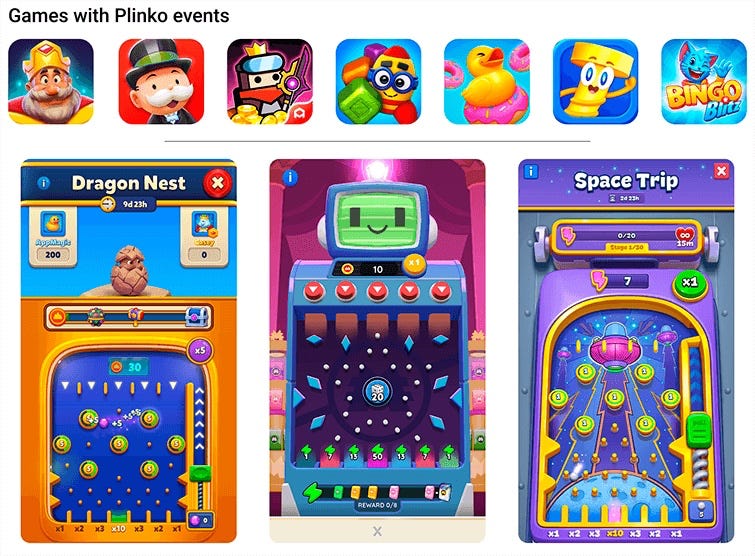

AppMagic highlights an fascinating development: on line casino mechanics (cube, slots, Plinko) more and more utilized in stay ops throughout non-casino genres, and generally even spun out into standalone video games.

-

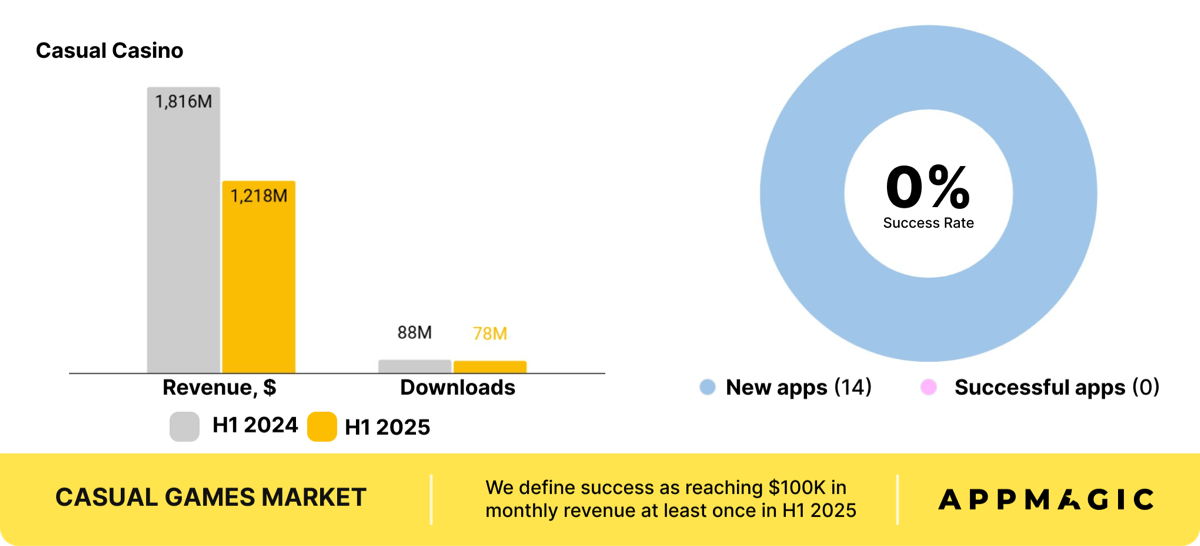

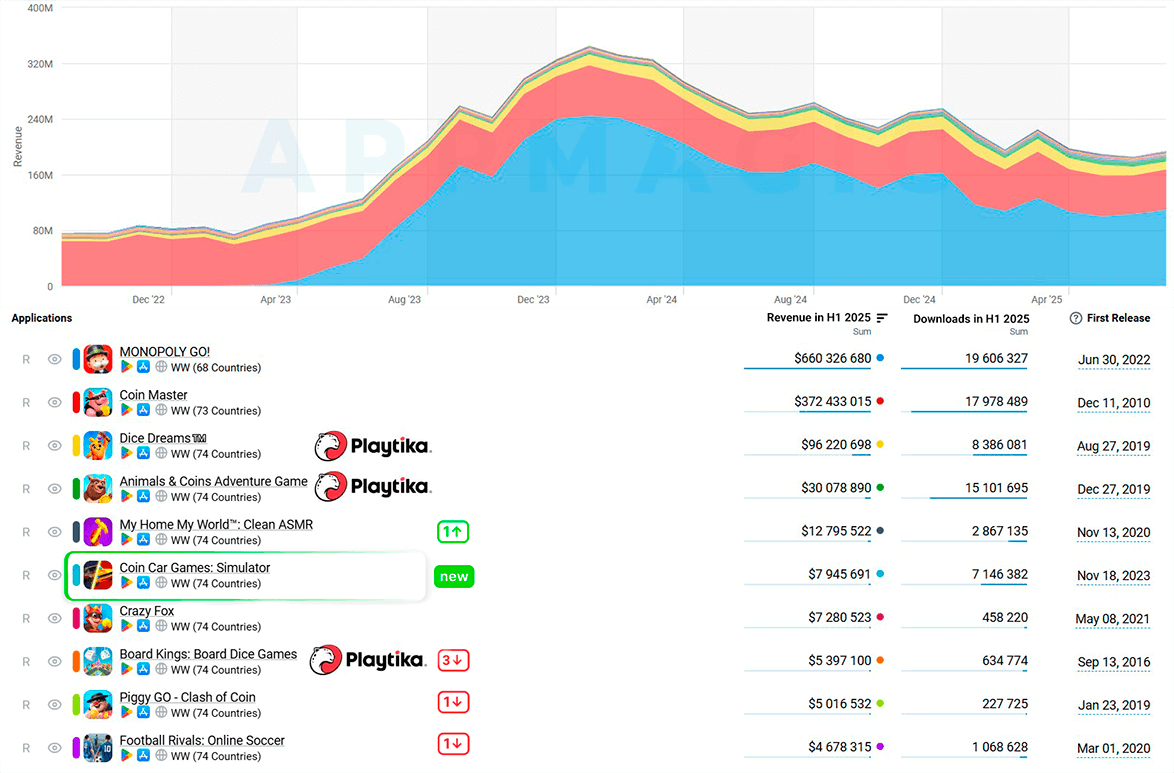

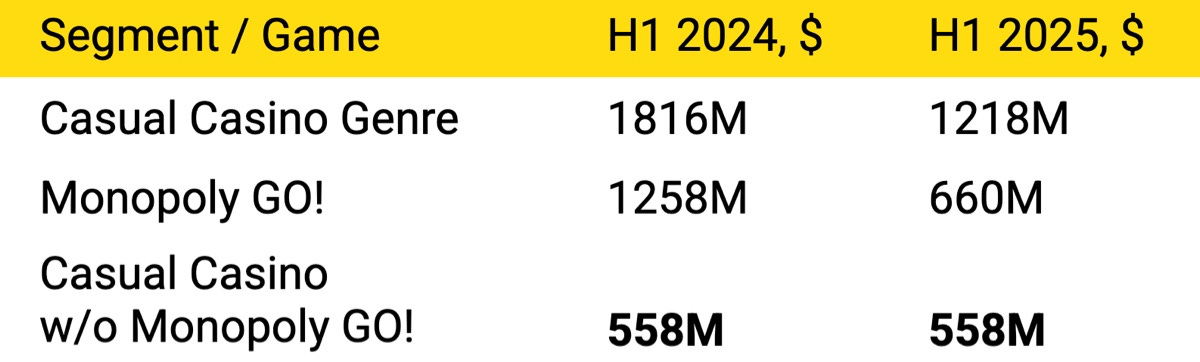

Revenue -33% YoY to $1.2B, primarily because of Monopoly GO!. In H1’24 alone, it earned $1.26B (greater than total subgenre in H1’25).

-

Playtika has bolstered its place in social on line casino. It acquired InnPlay Labs (Animals & Coins) in Sep 2024 and SuperPlay (Dice Dreams) in Nov 2024. By H1’25, mixed introduced in $136M (+5% YoY).

-

However, Playtika misplaced one long-running top-10 hit (Pirate Kings fell out). It was changed by Coin Car Games: Simulator, focusing on “male slots” with inspiration from Chrome Valley Customs.

-

Out of 14 new 2025 launches, none surpassed $100k month-to-month Net Revenue.

-

93% of income is concentrated in prime 3 titles.

-

Social on line casino could not develop a lot in income however nonetheless influences different genres. As an instance, Carnival Tycoon blends tycoon with social on line casino, already at $40M lifetime.

-

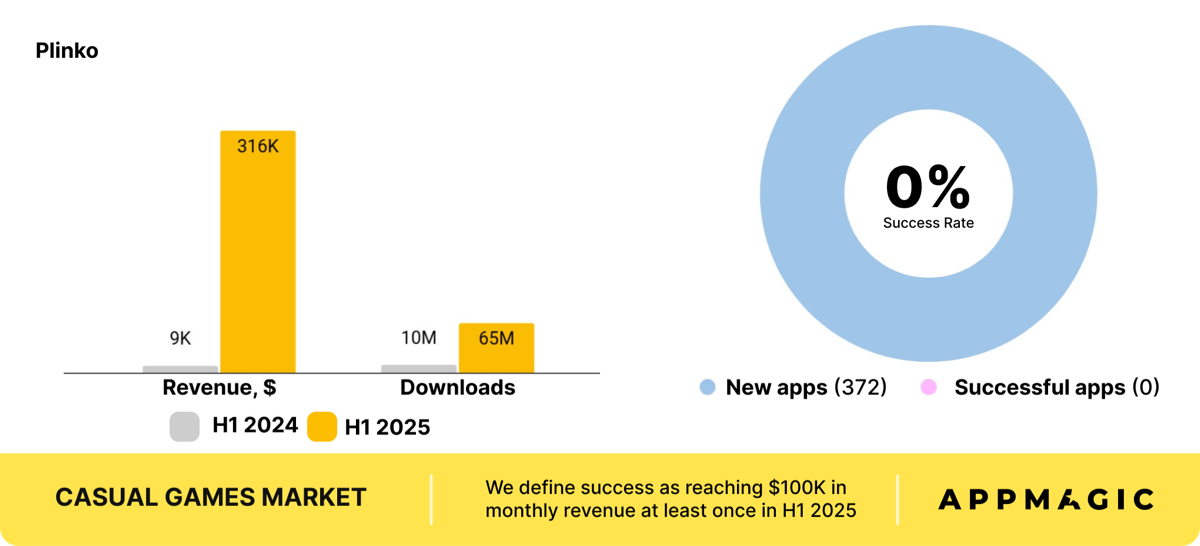

Plinko = gameplay the place a ball drops onto a peg board and bounces into prize slots on the backside.

-

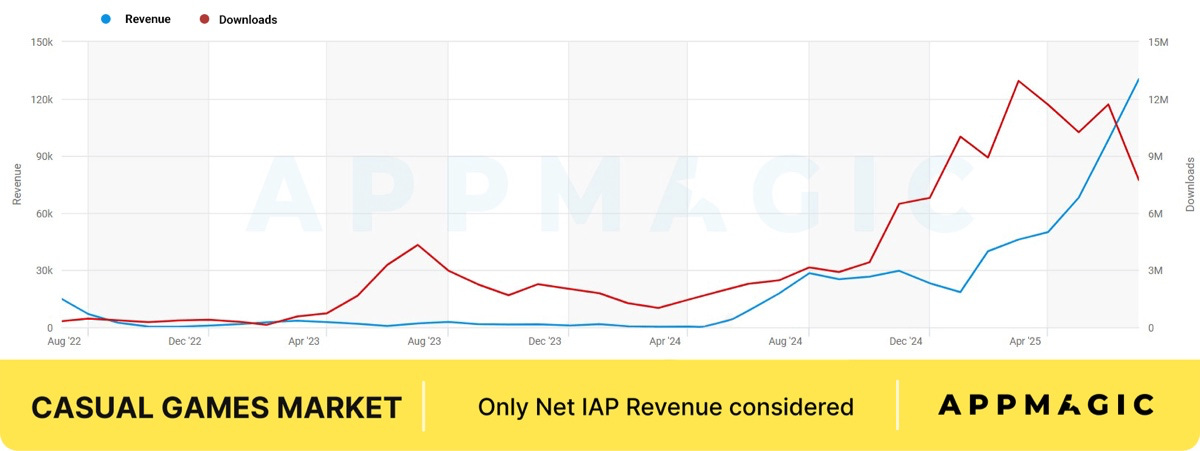

For years, Plinko Galaxy was the one monetizing title. In H1’25, income hit $316k (+3,600% YoY), installs x6.5 to 65M.

-

That mentioned, the subgenre’s development isn’t coming simply from new informal gamers abruptly drawn to the mechanic. One notable newcomer, Drop Balls x1000: Drop & Win, is an easy Plinko recreation and appears quite a bit like Plinko Galaxy. But they’re focusing on completely different participant bases: Drop Balls x1000: Drop & Win goes after India and Pakistan, whereas Plinko Galaxy is positioned primarily for the UK and Australia.

-

Subgenre seemingly gained’t get large, however nonetheless viable for regular earnings in area of interest markets.

-

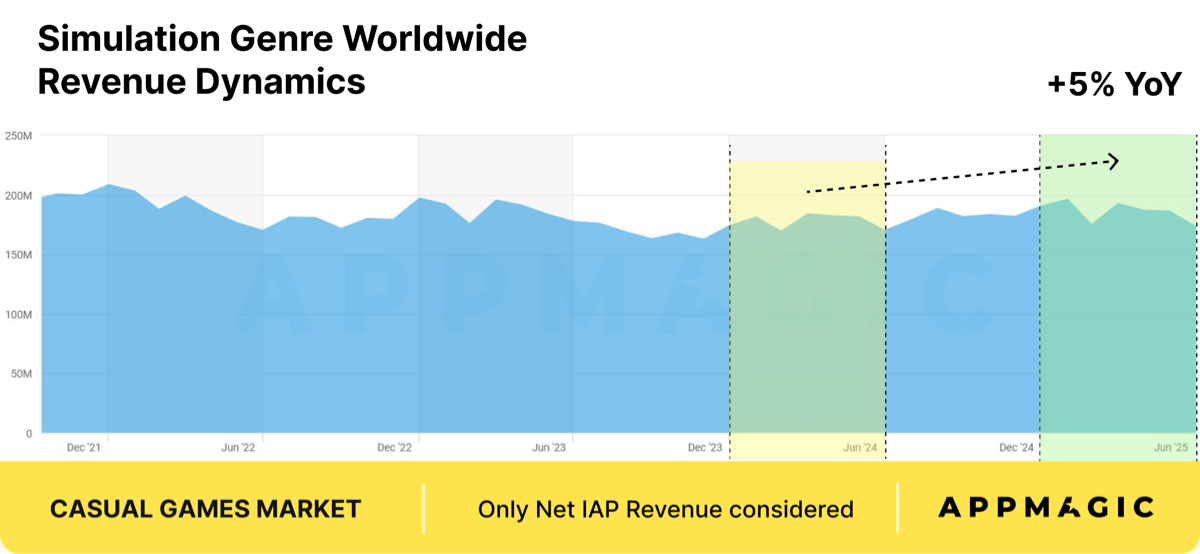

Simulation ranks #3 in IAP income amongst casuals: $1.1B in H1’25 (+5% YoY).

-

Largest subgenres:

-

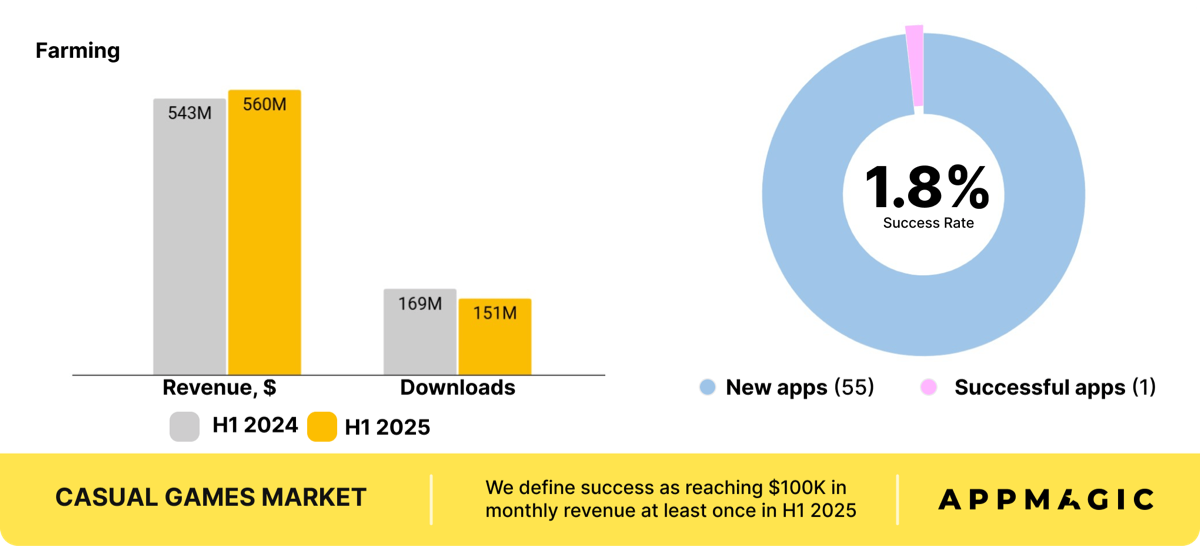

Farming: $560M (+3% YoY), 151M installs (-10.5% YoY)

-

Time Managers: $85M (-2.6% YoY), 261M installs (-2.6% YoY)

-

Life Sims: $80M (+30% YoY), 148M installs (-3% YoY)

-

-

1411 sim tasks launched in H1’25, however solely 55 had been farming video games (the dominant income driver). Just 0.4% of latest video games hit $100k month-to-month income.

-

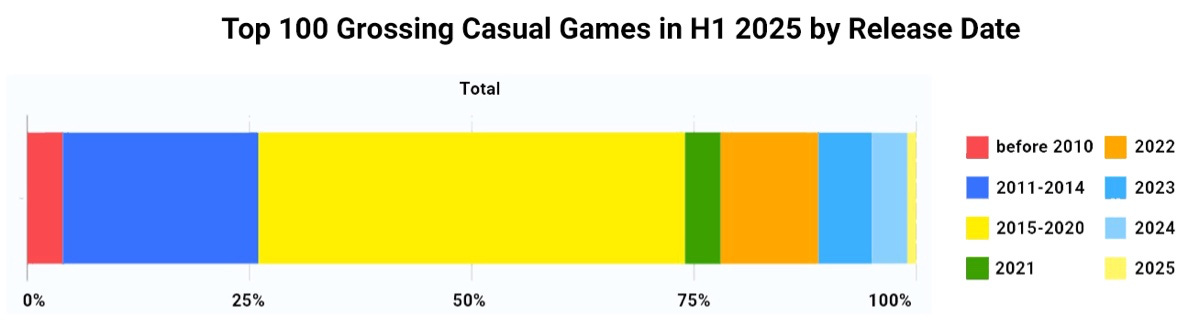

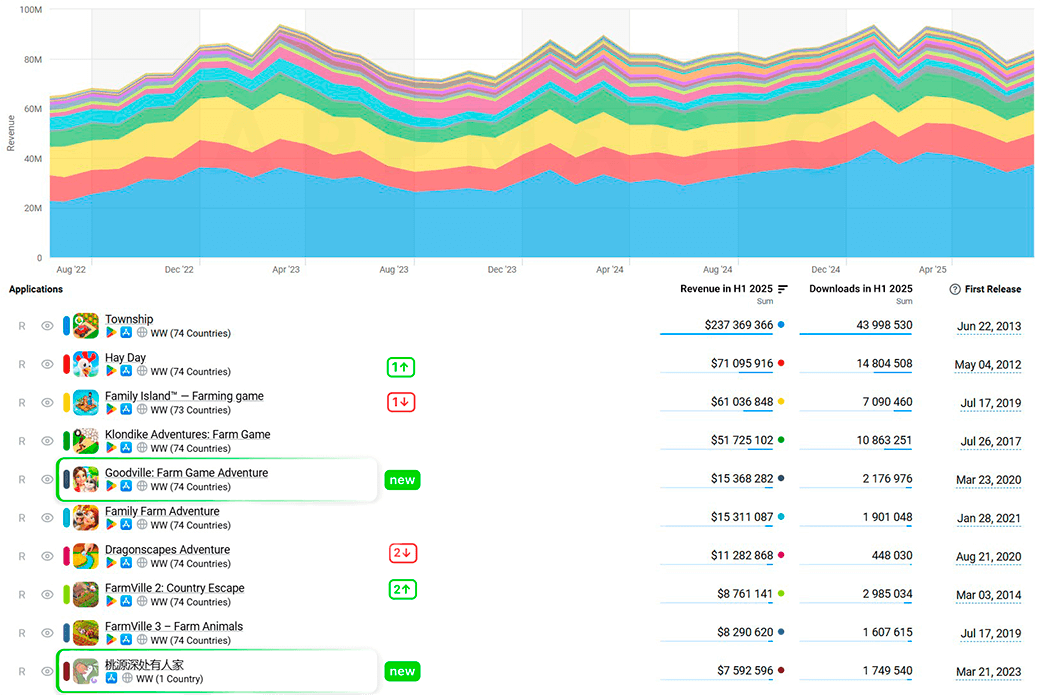

8 of top-10 farming titles launched between 2012–2020.

-

Township dominates with $237M in H1’25 (42% of whole). In January 2025, it additionally hit a private month-to-month file: $43.6M.

-

Hay Day hit $12.6M in April 2025 – finest since 2017.

-

AppMagic analysts observe that success is tied to aggressive stay ops. Township continuously integrates Match-3 occasions (a pure transfer for Playrix).

-

Only 1 of 55 new farm sims in 2025 handed $100k month-to-month Net Revenue.

-

Games to look at: Goodville: Farm Game Adventure (Goodville AG; steadily rising), Sunshine Island: Farming Game (Goodgame Studios; launched in 2023, not too long ago reaching $1M month-to-month income).

This web page was created programmatically, to learn the article in its unique location you’ll be able to go to the hyperlink bellow:

https://gamedevreports.substack.com/p/weekly-gaming-reports-recap-september-7f2

and if you wish to take away this text from our website please contact us