This web page was created programmatically, to learn the article in its unique location you may go to the hyperlink bellow:

https://www.cryptoninjas.net/news/pump-fun-funnels-436-million-in-usdc-out-of-solana-launchpad-amid-pump-token-collapse/

and if you wish to take away this text from our web site please contact us

Key Takeaways:

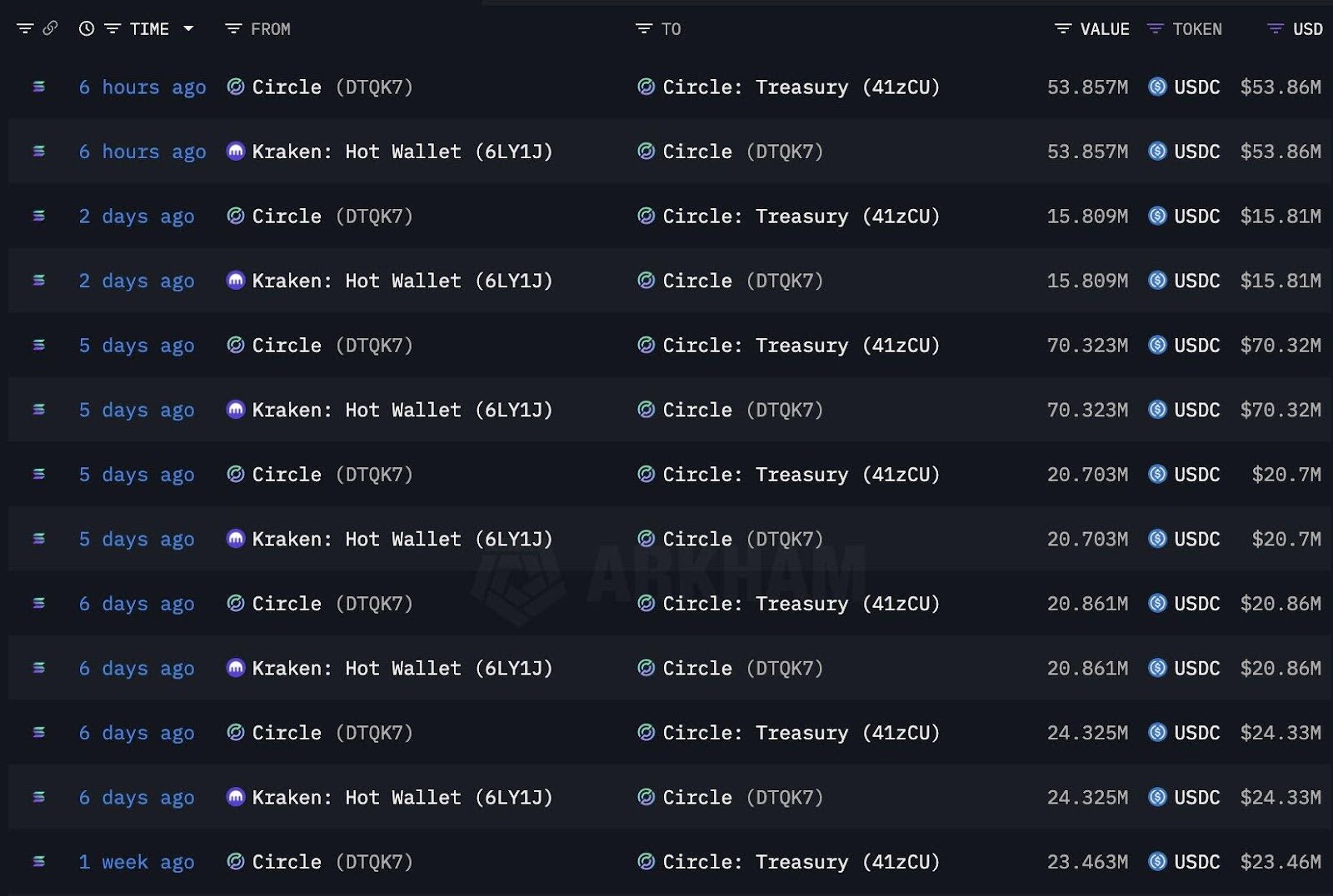

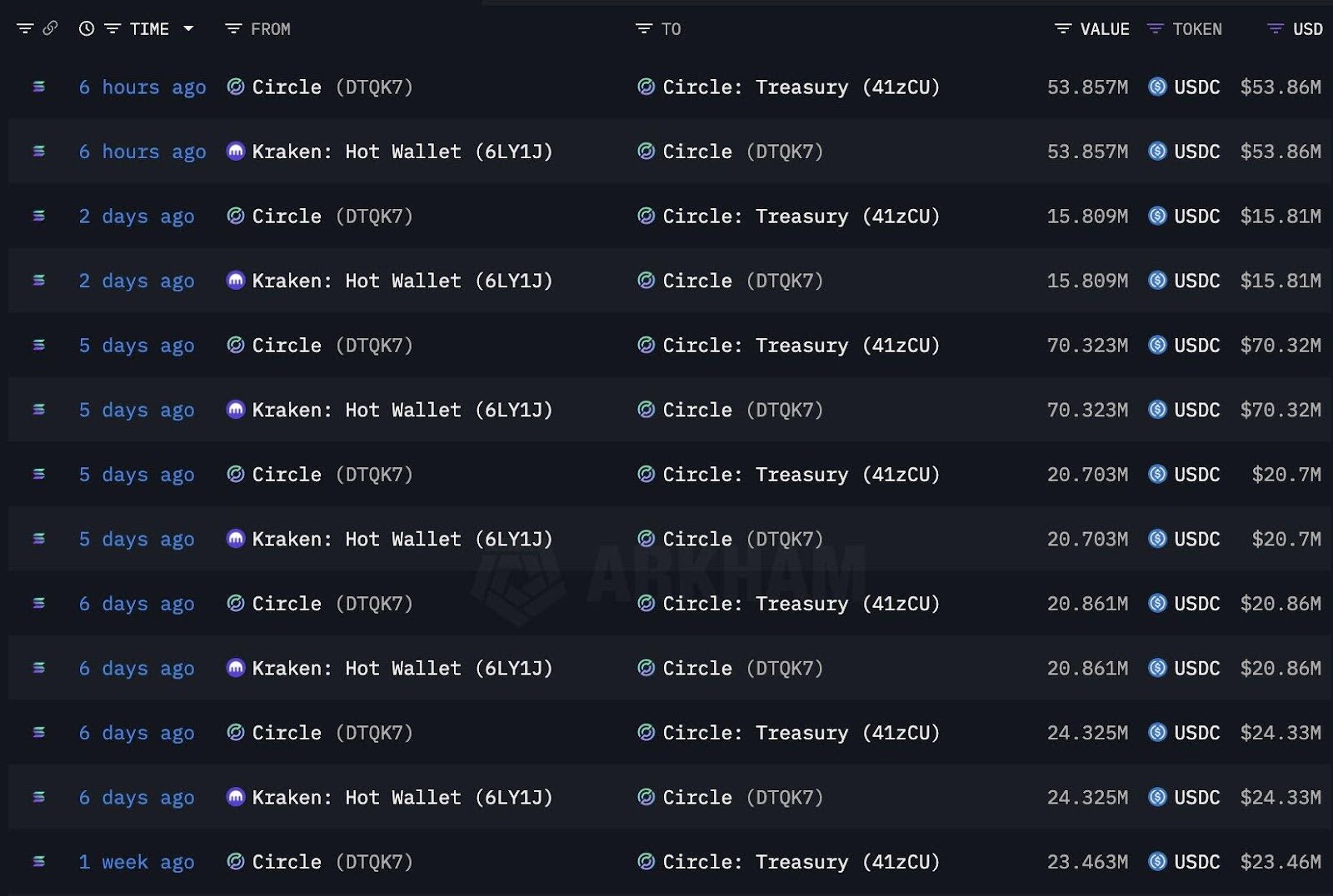

- On-chain information exhibits Pump.enjoyable has moved $436.5 million USDC into the change Kraken since October 15, and $537.6 million USDC from Kraken to Circle through pockets “DTQK7G.”

- Between May 19 2024 and August 12 2025 the platform bought 4.19 million SOL (~$757 million), together with 3.93 M SOL ($715.5 M) deposited into Kraken and 264,373 SOL ($41.6 M) bought instantly on-chain.

- The actions triggered intense group backlash and a steep decline within the native token PUMP, as retail customers query transparency and venture priorities.

Blockchain intelligence platforms present a doubtlessly large-scale cash-out operation. For the Solana-based launchpad Pump.enjoyable, what appears like revenue realization is going on whereas token holders stay largely at the hours of darkness.

Read More: Pump.enjoyable’s Massive $30.65M $PUMP Buyback Sparks Surge in Token Demand

The On-Chain Trace – How the Transfers Played Out

According to analysts and chain-data services, since mid-October Pump.enjoyable started a sustained USDC outflow:

- 436.5 M USDC deposited into Kraken.

- 537.6 M USDC subsequently moved from Kraken to Circle through the pockets DTQK7G.

Meanwhile, earlier information present the platform bought 4.19 million SOL tokens over a ~15-month span, translating to ~$757 million in worth: 264,373 SOL bought on-chain, and the remaining funneled into Kraken (3.93 M SOL / ~$715.5 M).

These figures point out that the venture’s token-liquidation and fundraising footprint is considerably bigger than beforehand seen, hinting at monetization slightly than reinvestment into ecosystem development.

Read More: Coinbase Makes Its Biggest Solana Push Yet with Strategic Acquisition of Vector’s Trading Tech

Impact on the PUMP Token & Community Sentiment

The native PUMP token has sharply underperformed amid these revelations: retail holders noticed a token value drop and voiced frustration on-line with key complaints:

- No seen air-drops, no enhanced incentives for loyal customers, regardless of massive token realisations.

- The administration of the launchpad was silent to the skin world with billions of {dollars} allegedly being transferred.

- People had stopped being speculative with enthusiasm to mistrust – a drain that’s deadly relating to a platform that depends on consumer momentum.

Large outs of the group or venture are traditionally recognized to trigger sudden value drops within the meme-coin or launchpad ecosystems. This seems to be the case: with massive asset actions coinciding with diminished ecosystem exercise, PUMP’s worth loop is beneath pressure.

Monitoring Signals

Token buyers ought to look ahead to:

- Large USDC or stable-coin flows into exchanges.

- Sudden drops in venture communications or ecosystem updates.

- Mismatch between token realisations and ecosystem improvement bulletins.

What This Means for PUMP Token Holders & Potential Buyers

- Existing holders: The signalling of huge asset actions raises warning: monitor spreads, buying and selling quantity, and governance disclosures.

- Prospective consumers: A token that has already witnessed main monetisation wants a restoration playbook: improved communication, token burn/air-drop programmes, clearer roadmap. Without these, upside could also be restricted.

- Risk-averse merchants: protocol execution threat and group monetisation threat Risk-averse merchants: Launchpad tokens are sometimes double-risk (group monetisation threat and protocol execution threat). Punishment by % distribution and stop-loss rationale is really useful.

This saga factors to one of many central developments in crypto: transparency is a extremely necessary consider innovation. On-chain flows which might be publicly out there don’t enable massive realizations to be hid.

This web page was created programmatically, to learn the article in its unique location you may go to the hyperlink bellow:

https://www.cryptoninjas.net/news/pump-fun-funnels-436-million-in-usdc-out-of-solana-launchpad-amid-pump-token-collapse/

and if you wish to take away this text from our web site please contact us