This web page was created programmatically, to learn the article in its unique location you possibly can go to the hyperlink bellow:

https://www.tomshardware.com/pc-components/gpus/nvidias-biggest-sea-customer-exposes-the-limits-of-us-ai-export-controls

and if you wish to take away this text from our website please contact us

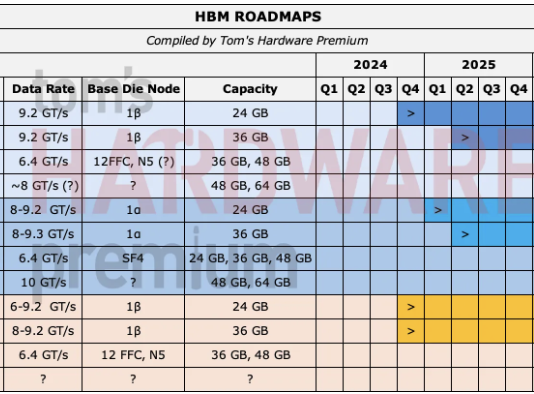

Tom’s Hardware Premium Roadmaps

When U.S. lawmakers tightened export controls on superior AI processors, their aim was simple sufficient: gradual China’s entry to cutting-edge compute {hardware} by limiting direct gross sales of essentially the most succesful GPUs. Three years later, the coverage is colliding with the realities of globalized provide chains, reseller-driven distribution fashions, and explosive demand for AI accelerators.

The company has rapidly become Nvidia’s largest buyer in Southeast Asia, and U.S. officials and Singaporean authorities are examining whether Megaspeed acted as a conduit for restricted Nvidia AI chips ultimately destined for China. According to a special report by Bloomberg, the size and pace of Megaspeed’s purchases, mixed with gaps between its declared information heart capability and the amount of {hardware} imported, have raised questions on whether or not U.S. export controls are being circumvented by means of third-party jurisdictions.

While Nvidia has stated it has discovered no proof of chip diversion previously, this newest episode regarding Megaspeed highlights the broader downside of export controls, that are stringent on paper however more and more troublesome to implement in follow as soon as {hardware} passes by means of layers of intermediaries.

Nvidia’s channel mannequin complicates enforcement

Nvidia doesn’t promote most of its information heart GPUs straight to finish customers. Instead, it depends on a sprawling ecosystem of distributors, system integrators, cloud suppliers, and regional companions. This mannequin scales effectively in regular markets, however it complicates enforcement when export guidelines hinge on finish use and last vacation spot quite than the purpose of sale.

After the U.S. Commerce Department imposed controls on A100 and H100 GPUs in October 2022, Nvidia responded by creating lower-spec China-only variants such because the A800 and H800. When these too have been restricted in late 2023, Nvidia introduced a new lineup of compliant parts, including the H20, L20, and L2. Each iteration was designed to remain below defined interconnect and performance thresholds while preserving software compatibility.

This approach allowed Nvidia to continue serving Chinese customers legally on paper; however, in practice, it also created a gray zone in which large volumes of AI hardware could be moved through third countries before regulators had clear visibility into where systems were deployed or how they were ultimately used. Once GPUs are installed in servers and shipped as complete systems, tracing individual accelerators becomes significantly harder.

Megaspeed managed to slot itself nicely within this gray zone. The company, which traces its roots to a Chinese gaming business that was subsequently spun out and rebranded in Singapore, reportedly committed to purchasing billions of dollars’ worth of Nvidia hardware over a short period. That drew attention, particularly when U.S. officials noticed discrepancies between the volume of chips imported and the capacity of Megaspeed’s disclosed data center footprint.

Singapore’s government has confirmed it is investigating potential export control violations, while U.S. agencies are examining whether restricted hardware was indirectly diverted to China.

A market ripe for smuggling

Unfortunately, the Megapseed situation is not an isolated incident. Over the past year, U.S. authorities have uncovered multiple schemes involving the illicit export of Nvidia GPUs to China, including instances in which companies misdeclared shipments, used shell entities, or physically removed accelerators from servers after inspection.

In late 2025, the U.S. Department of Justice shut down a major China-linked smuggling network that allegedly routed tens of millions of dollars’ worth of H100 and H200 GPUs to China by falsifying documentation and relabeling hardware. In a similar case, DeepSeek was accused of establishing “ghost” data centers in Southeast Asia to pass audits, then shipping GPUs onward.

These cases all highlight the difficulty of enforcing controls once hardware leaves Nvidia’s hands. Export rules are primarily enforced at the point of sale and shipment and rely heavily on declarations of end use and on downstream compliance by resellers and customers. When demand is strong enough, the incentives to circumvent those declarations multiply — and China’s appetite for AI compute remains enormous.

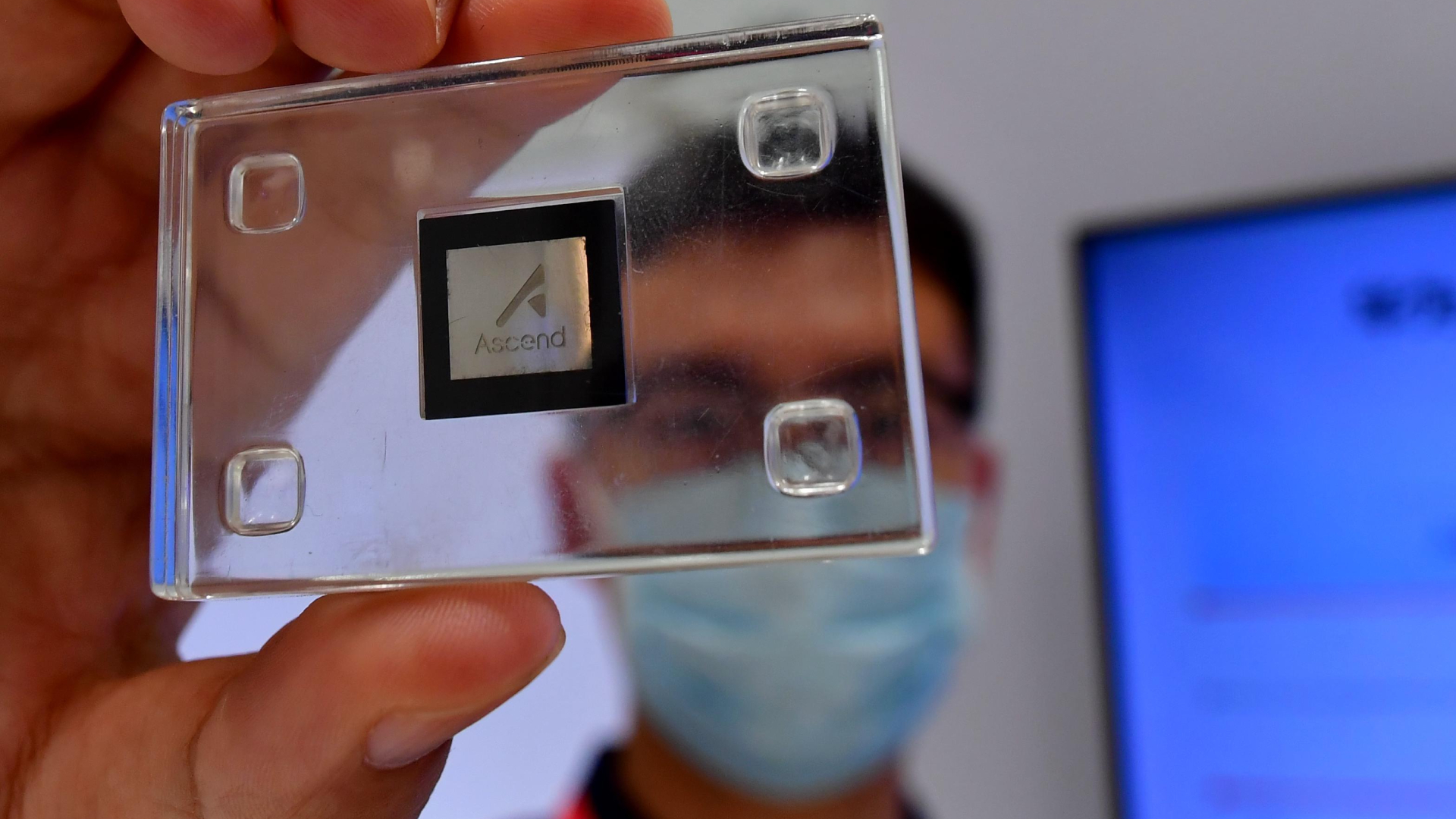

Domestic alternatives, including Huawei’s Ascend accelerators, have improved but still lag Nvidia in software maturity and ecosystem support. Even Chinese firms that publicly promote local silicon often rely on Nvidia hardware for training large models or running advanced inference workloads. That persistent demand has created a shadow market willing to pay significant premiums for restricted GPUs.

Policy goals vs supply chain vs Chinese demand

From Washington’s perspective, export controls are intended to impose real friction on China’s AI development by constraining access to the highest-end compute. The logic is that advanced model training scales with available GPU throughput, memory bandwidth, and interconnect performance. Denying that hardware should slow progress in both commercial and military AI applications.

The problem is that for China, which is so far behind the West in real terms, partial access is still extremely meaningful. Even a modest influx of smuggled or otherwise indirectly routed GPUs can support the likes of research projects and inference deployments. While it’s estimated that illicit imports account for only a fraction of China’s total compute capacity, even marginal gains can make a big difference at the frontier of model development.

At the same time, aggressive controls carry trade-offs. They push Chinese companies to accelerate domestic chip development, fragment global supply chains, and incentivize exactly the kinds of gray-market behavior now under investigation. They also place companies like Nvidia in a difficult position, caught between compliance obligations and the commercial reality that much of their addressable market lies outside the U.S. and its closest allies.

In early 2025, the Commerce Department expanded controls to cover not just hardware but also certain AI model weights, while creating new licensing frameworks for trusted partners and data center operators.

Whether or not investigators ultimately find evidence that Megaspeed violated export laws, there’s a structural weakness in the current system. Export controls assume that intermediaries can be trusted to enforce end-use restrictions at scale, across borders, and over time. As long as global demand for Nvidia-class AI compute outpaces legal supply to China, however, pressure will build on the seams of the system.

Follow Tom’s Hardware on Google News, or add us as a preferred source, to get our newest information, evaluation, & evaluations in your feeds.

This web page was created programmatically, to learn the article in its unique location you possibly can go to the hyperlink bellow:

https://www.tomshardware.com/pc-components/gpus/nvidias-biggest-sea-customer-exposes-the-limits-of-us-ai-export-controls

and if you wish to take away this text from our website please contact us