This web page was created programmatically, to learn the article in its authentic location you may go to the hyperlink bellow:

https://gadget.co.za/huaweivivoapple18m/

and if you wish to take away this text from our web site please contact us

Mainland China’s smartphone market declined 1% yr on yr in 2025, and full-year shipments reached 282.3-million items, based on a brand new report from international expertise analysis and advisory group Omdia.

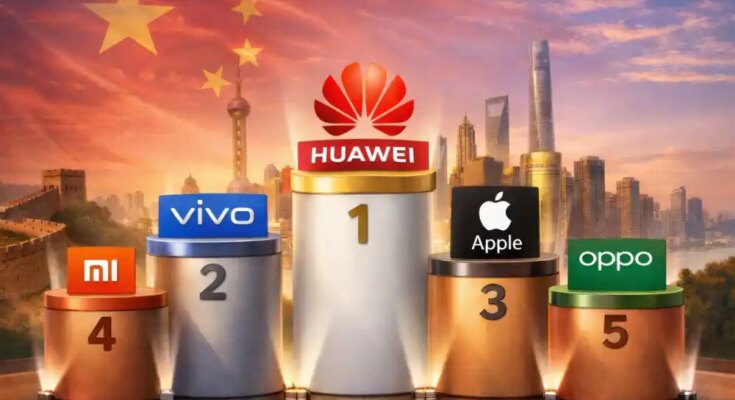

Market management modified, however a really slim hole exists between the highest three manufacturers.

With a cargo of 46.8-million items, Huawei returned to the highest spot, accounting for a 17% market share. Vivo carefully adopted in second place with 46-million items shipped and a 16% market share. Benefiting from its sturdy efficiency within the fourth quarter, Apple maintained its place within the prime three with an annual cargo quantity of 45.9-million items. Xiaomi shipped 43.7-million items and Oppo 42.8-million items, securing the fourth and fifth positions respectively.

In 4Q25, pushed by year-end promotions and the continuation of nationwide subsidy insurance policies, the general market decline moderated. The mainland China smartphone market posted a 1% year-on-year lower within the fourth quarter, with shipments reaching 76.4-million items. Apple led the market with 16.5-million items shipped in 4Q25, accounting for a 22% market share. Vivo ranked second with 11.9-million items and a 16% market share. Oppo’s market efficiency rebounded, with shipments reaching 11.6-million items, rising two positions year-on-year within the prime three. Huawei shipped 11.1-million items to rank fourth, carefully adopted by Xiaomi with 10.0-million items shipped.

“Apple achieved solid shipment growth by leveraging a product differentiation and upgrade strategy, supporting overall volumes while refining its portfolio,” says Hayden Hou, Omdia principal analyst. “In addition to sturdy shopper reception for the redesigned iPhone 17 Pro collection, the iPhone 17 options complete upgrades to storage and show specs whereas sustaining the identical entry-level pricing as its predecessor. Its contribution inside the product combine has surpassed that of earlier base fashions.

“Local brands are steadily advancing their premiumisation strategies. Huawei has increased its investment in HarmonyOS and carried out a comprehensive upgrade, launching HarmonyOS 6 in October and committing RMB1-billion to support innovation in the HarmonyOS and AI ecosystem. Xiaomi brought forward the launch of its flagship Xiaomi 17 Ultra to December, releasing the device ahead of its competitors’ new product rollouts.”

Omdia analyst Lucas Zhong mentioned: “As we predicted at the beginning of 2025, the influence of nationwide subsidy insurance policies on the market is especially mirrored in pulling demand ahead quite than producing natural development. Due to inconsistencies in nationwide subsidies within the second and third quarters, the market skilled an adjustment interval.

“However, based on the practices implemented in 2025, all brands, including Apple, have completed their deployments by restructuring product portfolios and adjusting pricing strategies. Channel partners have gained valuable experience over the past year and established operational processes. Along with the year-end and upcoming national subsidy policies, this provides a stable and positive foundation for market development in 2026.”

Hou mentioned that, in 2026, rising prices would turn out to be a significant problem for smartphone distributors in each mainland China and international markets.

“Rising reminiscence prices are making a extremely dynamic atmosphere for element provide, product technique, and pricing technique, compelling distributors to strategically steadiness price allocation, value competitiveness, and {hardware} improve paths.

“Despite short-term price pressures, distributors are sustaining investments in long-term worth drivers, together with channel enhancements – corresponding to flagship retailer expansions and renovations – AI and cross-device ecosystem improvement, and imaging innovation. We anticipate 2026 to stay a yr of worth development and product innovation in Mainland China’s smartphone market. “

This web page was created programmatically, to learn the article in its authentic location you may go to the hyperlink bellow:

https://gadget.co.za/huaweivivoapple18m/

and if you wish to take away this text from our web site please contact us