This page was generated automatically; to view the article in its initial source you can follow the link below:

https://simplywall.st/stocks/us/retail/nasdaq-tklf/tokyo-lifestyle/news/tokyo-lifestyle-nasdaqtklf-may-have-issues-allocating-its-ca

and should you wish to have this article removed from our website, please reach out to us

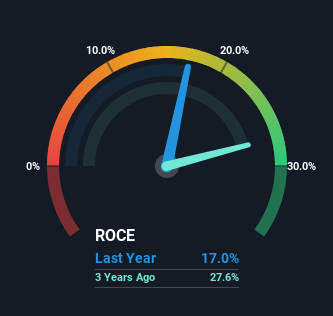

In case you’re uncertain about where to initiate your search for the next significant stock, there are several essential trends to keep track of. Generally, we should be attentive to a pattern of increasing return on capital employed (ROCE), accompanied by a growing base of capital employed. Essentially, this indicates that a firm has lucrative projects it can continue to reinvest in, a characteristic of a compounding entity. That said, upon an initial review of Tokyo Lifestyle (NASDAQ:TKLF), we aren’t exactly thrilled by the current trend of returns, but let’s examine it in greater detail.

What Is Return On Capital Employed (ROCE)?

For clarification, if you’re not familiar, ROCE is a metric that assesses how much pre-tax income (expressed as a percentage) a company generates on the capital invested in its operations. Analysts use the following formula to determine this for Tokyo Lifestyle:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.17 = US$8.7m ÷ (US$159m – US$108m) (Based on the trailing twelve months to September 2024).

Thus, Tokyo Lifestyle boasts an ROCE of 17%. While this is a decent return on its own, it significantly outshines the 13% produced by the Specialty Retail sector.

Discover our latest analysis for Tokyo Lifestyle

Examining historical performance is an excellent starting point when investigating a stock, so above, you can observe Tokyo Lifestyle’s ROCE compared to its past returns. If you’re interested in exploring historical earnings, check out these free charts illustrating the revenue and cash flow performance of Tokyo Lifestyle.

The Trend Of ROCE

Regrettably, the trend is not promising with ROCE declining from 38% five years prior, while the capital employed has escalated by 134%. Typically, this isn’t favorable; however, considering that Tokyo Lifestyle undertook a capital raising prior to their latest earnings report, this would likely have contributed, at least in part, to the heightened capital employed figure. The capital raised may not have been deployed yet, making it important to observe how Tokyo Lifestyle’s earnings evolve going forward as a consequence of the capital increase.

On a related note, Tokyo Lifestyle’s current liabilities remain somewhat elevated at 68% of total assets. This poses certain risks since the company is reliant on its suppliers or various short-term creditors. Although it’s not inherently negative, having a lower ratio could be advantageous.

In Conclusion…

Although capital returns have decreased in the short term, we find it encouraging that both revenue and capital employed have risen for Tokyo Lifestyle. Nevertheless, despite these hopeful trends, the stock has declined by 62% over the previous year, suggesting a potential opportunity for discerning investors. Therefore, we believe it is worthwhile to investigate this stock further given the promising trends.

One last note: We’ve pinpointed 5 cautionary indicators with Tokyo Lifestyle (at least 2 of which raise some concerns), and understanding these aspects would certainly be beneficial.

While Tokyo Lifestyle might not presently deliver the highest returns, we’ve compiled a list of companies yielding more than 25% return on equity. Explore this free list here.

Valuation is intricate, but we are here to clarify it.

Discover if Tokyo Lifestyle could be undervalued or overvalued through our comprehensive analysis, including fair value estimates, potential risks, dividends, insider transactions, and its financial state.

Access Free Analysis

Have thoughts regarding this article? Concerned about the content? Contact us directly. Alternatively, reach out via email to editorial-team (at) simplywallst.com.

This article by Simply Wall St is of a general nature. We provide insights based on historical data and analyst forecasts solely using an impartial methodology, and our articles are not intended to serve as financial advice. It does not represent a recommendation to purchase or sell any stock and does not account for your objectives or financial status. Our aim is to deliver long-term oriented analysis driven by fundamental data. Please note that our analysis may not include the latest price-sensitive company announcements or qualitative information. Simply Wall St holds no position in any stocks discussed.

This page was generated automatically; to view the article in its initial source you can follow the link below:

https://simplywall.st/stocks/us/retail/nasdaq-tklf/tokyo-lifestyle/news/tokyo-lifestyle-nasdaqtklf-may-have-issues-allocating-its-ca

and should you wish to have this article removed from our website, please reach out to us